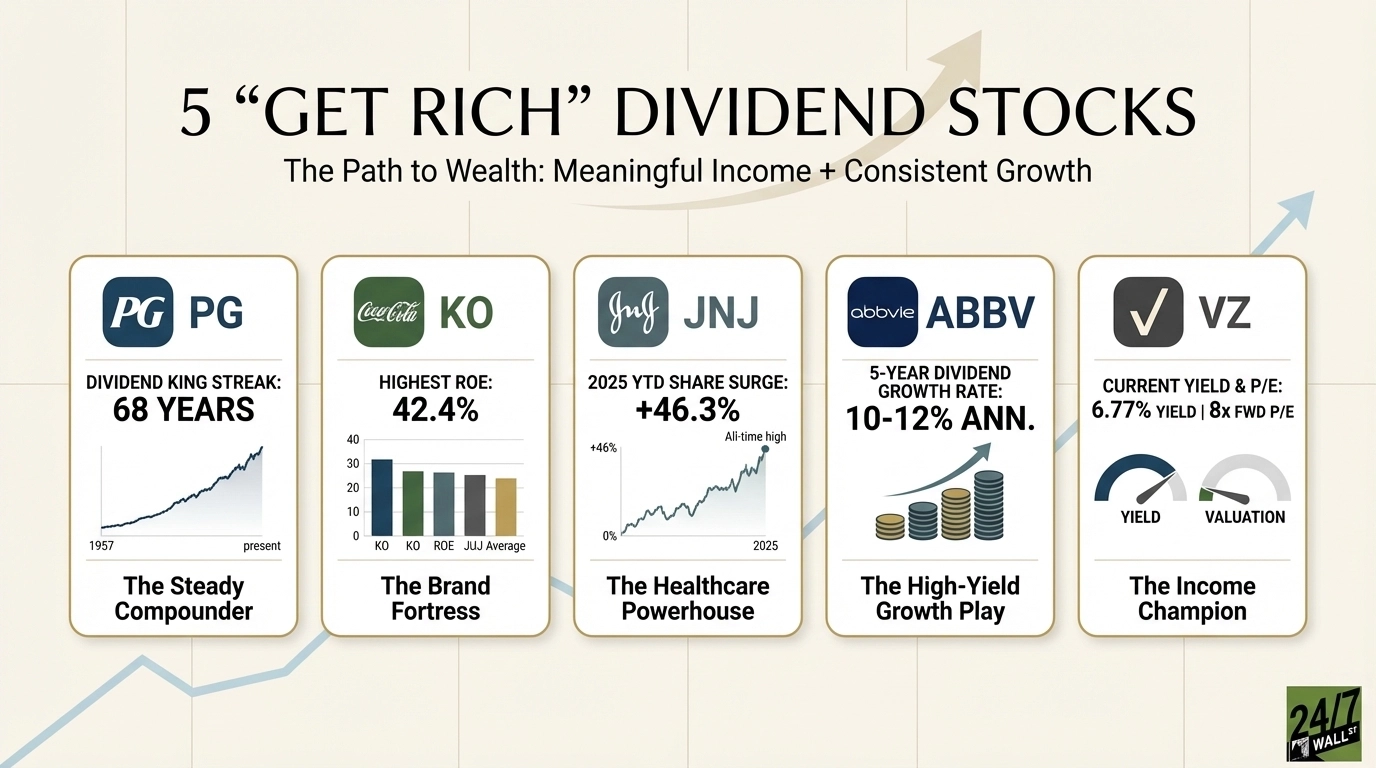

"Building wealth through dividends requires more than chasing high yields. The path to "getting rich" combines meaningful current income with consistent dividend growth, backed by sustainable business fundamentals. These five stocks deliver that combination, each offering distinct advantages for compounding wealth over time. #5: Procter & Gamble (PG): The Steady Compounder Procter & Gamble earns its place as a 68-year Dividend King, having increased its payout annually since 1957. The consumer staples giant recently raised its quarterly dividend to $1.06, maintaining a 2.93% yield"

"#4: Coca-Cola (KO): The Brand Fortress Coca-Cola's 62-year dividend growth streak proves that owning the world's most recognized beverage brand generates reliable income. The quarterly dividend of $0.50 provides a 2.92% yield, with recent increases averaging 5.2% year-over-year. Q3 2025 results showed the power of KO's global distribution network: EPS of $0.86 crushed estimates of $0.78, while revenue of $12.46 billion beat expectations. Organic revenue growth of 6% reflected strong international demand, and the company gained market share in nonalcoholic beverages despite intense competition."

Building wealth through dividends requires more than chasing high yields and relies on combining current income with consistent dividend growth and solid fundamentals. Procter & Gamble, a 68-year Dividend King, raised its quarterly dividend to $1.06 for a 2.93% yield and has averaged 6% annual dividend growth over five years. Q1 fiscal 2026 EPS of $1.95 beat estimates and revenue reached $22.40 billion with 2% organic growth, supported by a 19.7% profit margin and 31.9% ROE while returning $3.8 billion to shareholders. Coca-Cola, with a 62-year streak, yields 2.92% and posted strong Q3 2025 results with $12.46 billion revenue and 6% organic growth.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]