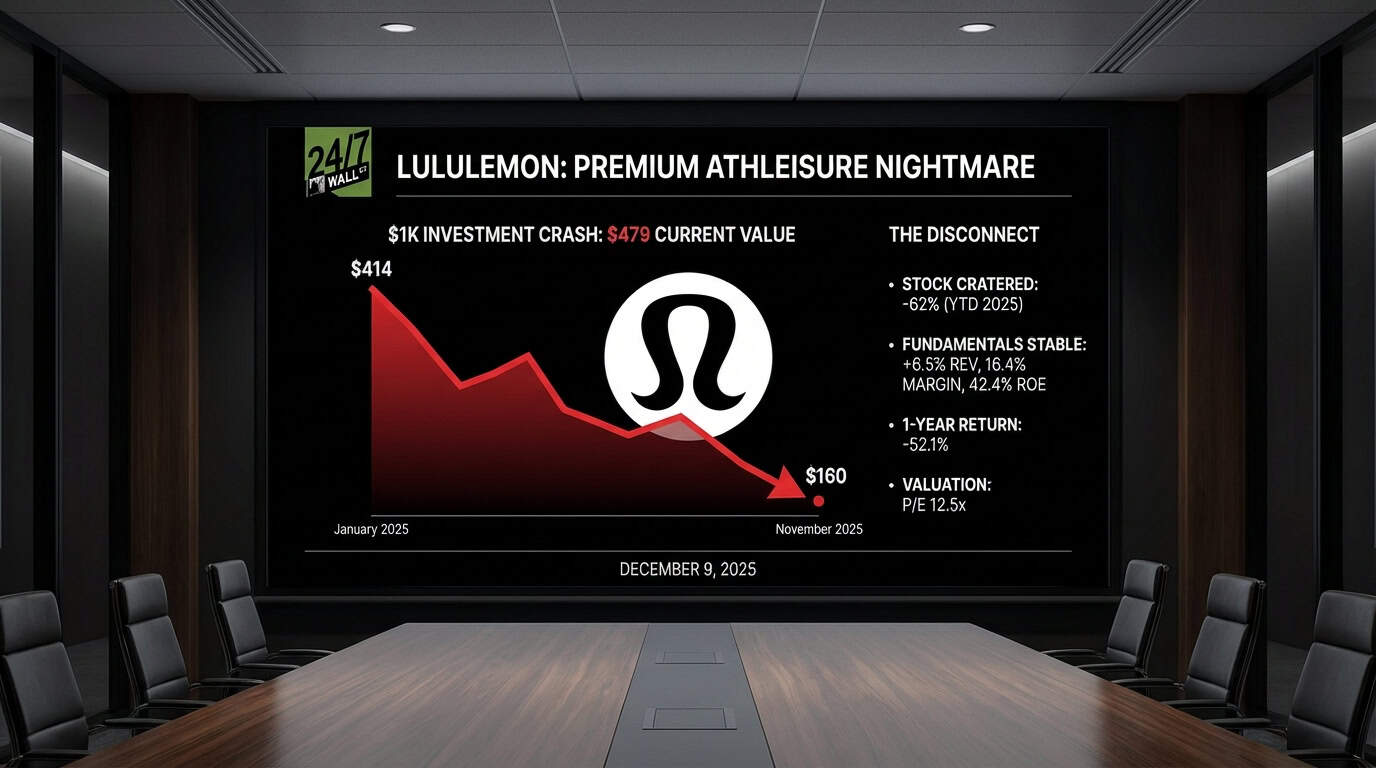

"Then 2025 happened. What started as a stock trading at $414 in January collapsed to $160 by November, a 62% freefall that destroyed billions in market value. The company didn't implode. Revenue still grew 6.5% year over year. Earnings dipped just 1.6%. Lululemon beat analyst estimates in eight of the last ten quarters, including a 7.3% surprise in its most recent report. The fundamentals stayed remarkably stable while the stock price cratered."

"The disconnect between business performance and stock performance defines the Lululemon story of 2025. While competitors struggled with margin pressure, LULU maintained a 16.4% profit margin and 42.4% return on equity. The company generated nearly $11 billion in trailing revenue. Yet investors fled anyway, treating the stock like a failing retailer rather than a profitable growth company trading at just 12.5 times earnings."

Lululemon built a premium athleisure franchise by combining technical innovation, lifestyle branding, and premium pricing to dominate high-margin athletic wear. In 2025 the stock fell from $414 to $160, a 62% decline that wiped out billions in market value. Revenue grew 6.5% year over year and earnings dipped only 1.6%, with the company beating analyst estimates in eight of ten quarters and delivering a 7.3% surprise in the most recent report. Profit margin remained 16.4% and return on equity 42.4%, with nearly $11 billion in trailing revenue. Despite these fundamentals, investor selling produced severe losses for shareholders.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]