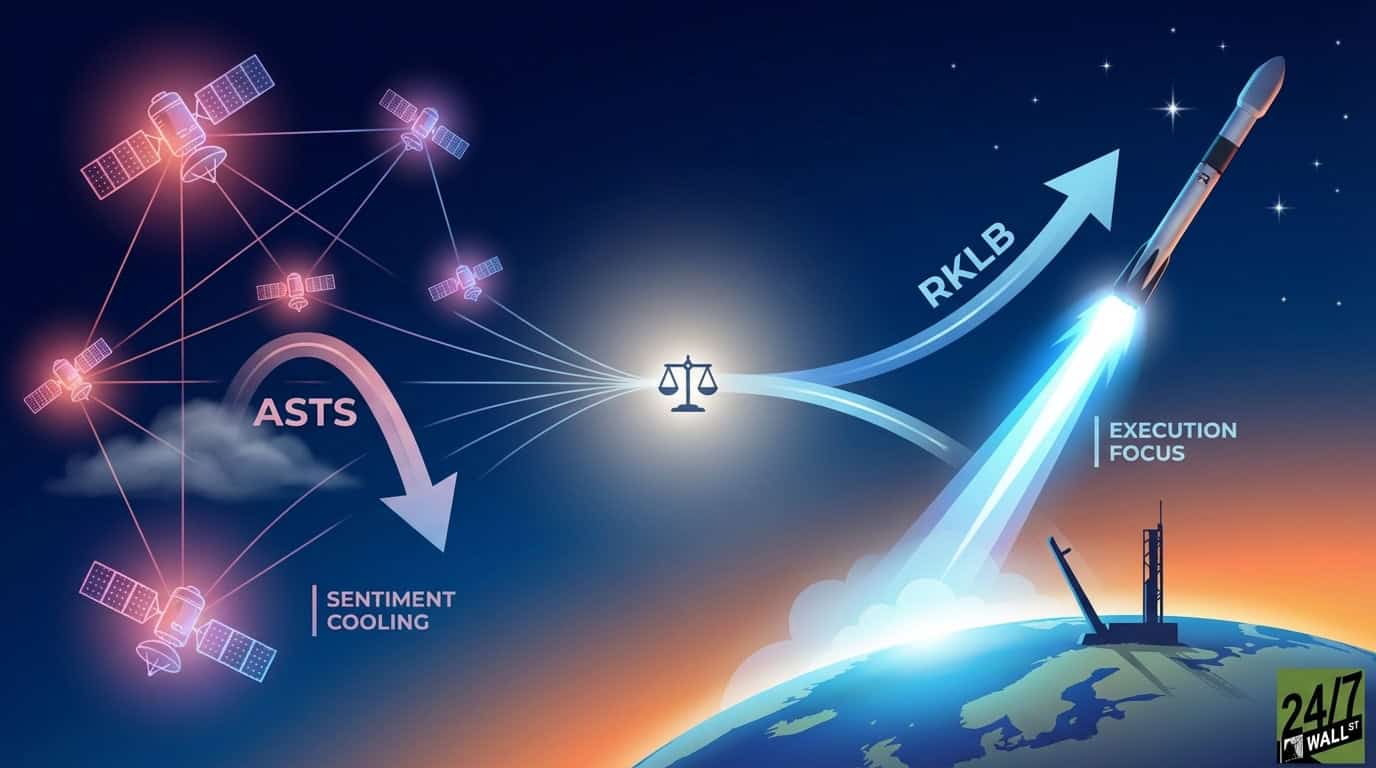

"Shares of AST SpaceMobile ( NASDAQ:ASTS) and Rocket Lab ( NASDAQ:RKLB) are drawing intense retail attention in December, with both space stocks registering neutral sentiment scores of 53 as of this morning. That marks a significant cooldown from early December, when AST SpaceMobile held sentiment scores consistently above 88 through December 7-8, while Rocket Lab hovered in the 78-82 range. The convergence tells a story of shifting retail conviction as both stocks navigate similar market caps near $30 billion but wildly different operational realities."

"AST SpaceMobile dominated social sentiment through early December, averaging 82.5 across the seven-day period compared to Rocket Lab's 70.5. The enthusiasm centered on the company's satellite constellation plans, with retail traders on r/stocks and r/investing repeatedly naming ASTS among their top growth picks for 2026. One commenter on the r/stocks thread noted: "ASTS is one of the most exciting growth opportunities heading into 2026.""

"But the fundamentals paint a different picture. AST SpaceMobile missed Q3 estimates by 114%, reporting a loss of $0.45 per share against expectations of $0.21. Revenue of $14.74M fell short of the $20.33M estimate, and the company trades at 1,567x price-to-sales. The stock carries a 2.76 beta. Despite $1.2B in cash and over $1B in contracted revenue commitments, the path to profitability remains distant as the company targets 45-60 satellites by end of 2026."

Retail sentiment for AST SpaceMobile and Rocket Lab cooled to neutral levels of 53 in December after earlier higher readings. AST SpaceMobile held sentiment consistently above 88 through December 7-8 while Rocket Lab previously hovered in the 78-82 range. AST SpaceMobile missed Q3 estimates by 114%, reporting a $0.45 per share loss versus an expected $0.21, with revenue of $14.74M versus a $20.33M estimate and trading at 1,567x price-to-sales. The company has $1.2B cash and over $1B in contracted revenue but targets 45-60 satellites by end of 2026. Rocket Lab beat Q3 estimates by 71%, reporting a $0.03 loss, $155.08M revenue, 48% year-over-year growth, 17 Electron launch contracts and 37% gross margins.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]