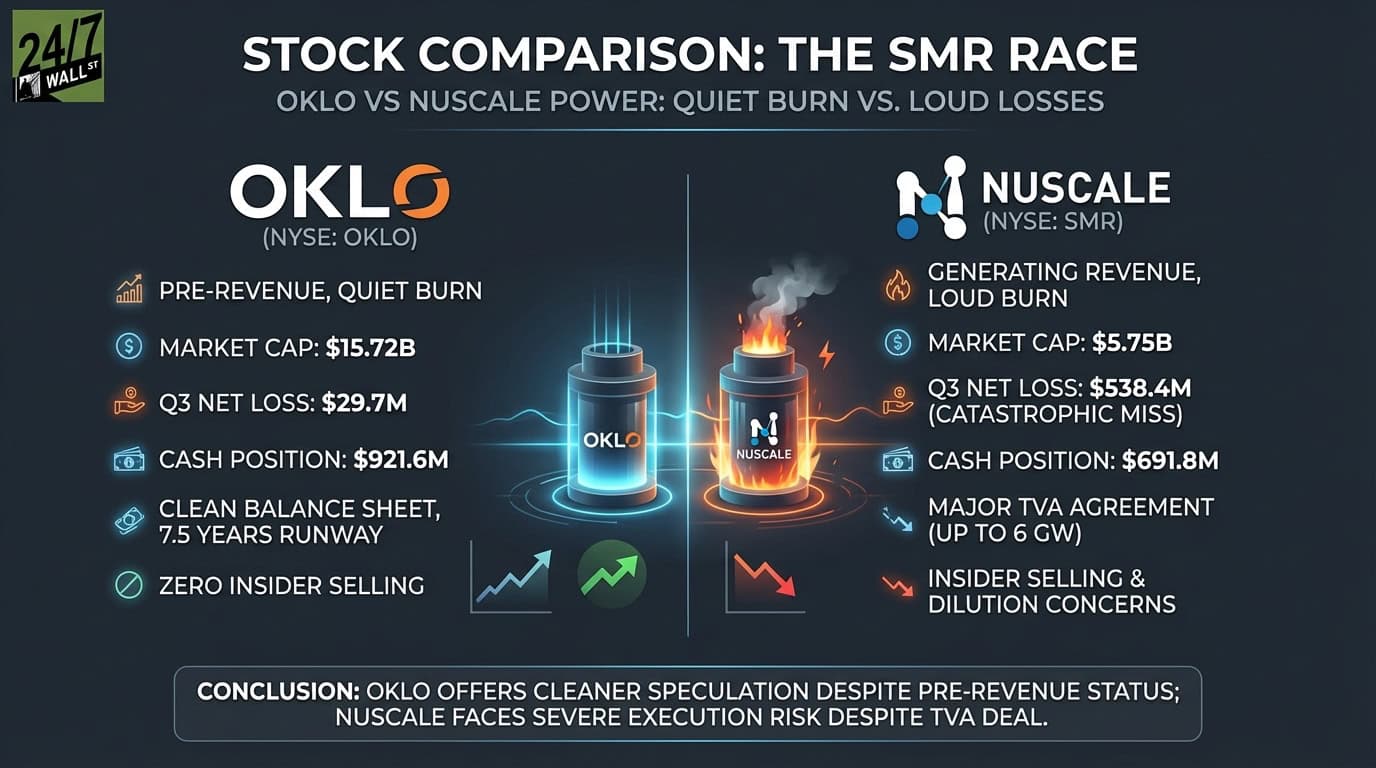

"Oklo posted a Q3 net loss of $29.7 million, maintaining its pre-revenue development posture. The company holds $921.6 million in cash and short-term investments against just $40.6 million in liabilities, providing approximately 7.5 years of runway at current burn rates. R&D consumed $14.9 million in the quarter, with SG&A adding another $21.4 million. Management has offered no concrete revenue timeline."

"NuScale took a different path. On November 6, 2025, the company reported Q3 results that missed estimates by 1,323%. The reported loss of $1.85 per share compared to analyst expectations of negative $0.13. Revenue of $8.24 million came in below the $11.17 million estimate. The massive loss stemmed from a $495 million milestone contribution to ENTRA1 under a partnership agreement. Operating losses hit $538.4 million versus $41 million in the prior year."

"NuScale did announce a major win: a TVA agreement for up to 6 gigawatts of SMR capacity, which CEO John Hopkins called "the largest SMR deployment program in U.S. history." The company also raised $475.2 million through an at-the-market offering, issuing 13.2 million shares. But the combination of dilution, earnings disaster, and one-time charges left investors questioning execution."

Oklo reported a Q3 net loss of $29.7 million while remaining pre-revenue and burning roughly $30 million per quarter. The company holds $921.6 million in cash and short-term investments against $40.6 million in liabilities, providing approximately 7.5 years of runway at current burn rates. R&D was $14.9 million and SG&A was $21.4 million in the quarter, with no revenue timeline provided. NuScale reported $8.24 million in revenue and a Q3 loss of $1.85 per share driven by a $495 million milestone contribution to ENTRA1 and $538.4 million in operating losses. NuScale secured a TVA agreement for up to 6 GW and raised $475.2 million through an at-the-market offering. Technical indicators show Oklo RSI near 49.31 and NuScale RSI near 41.78.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]