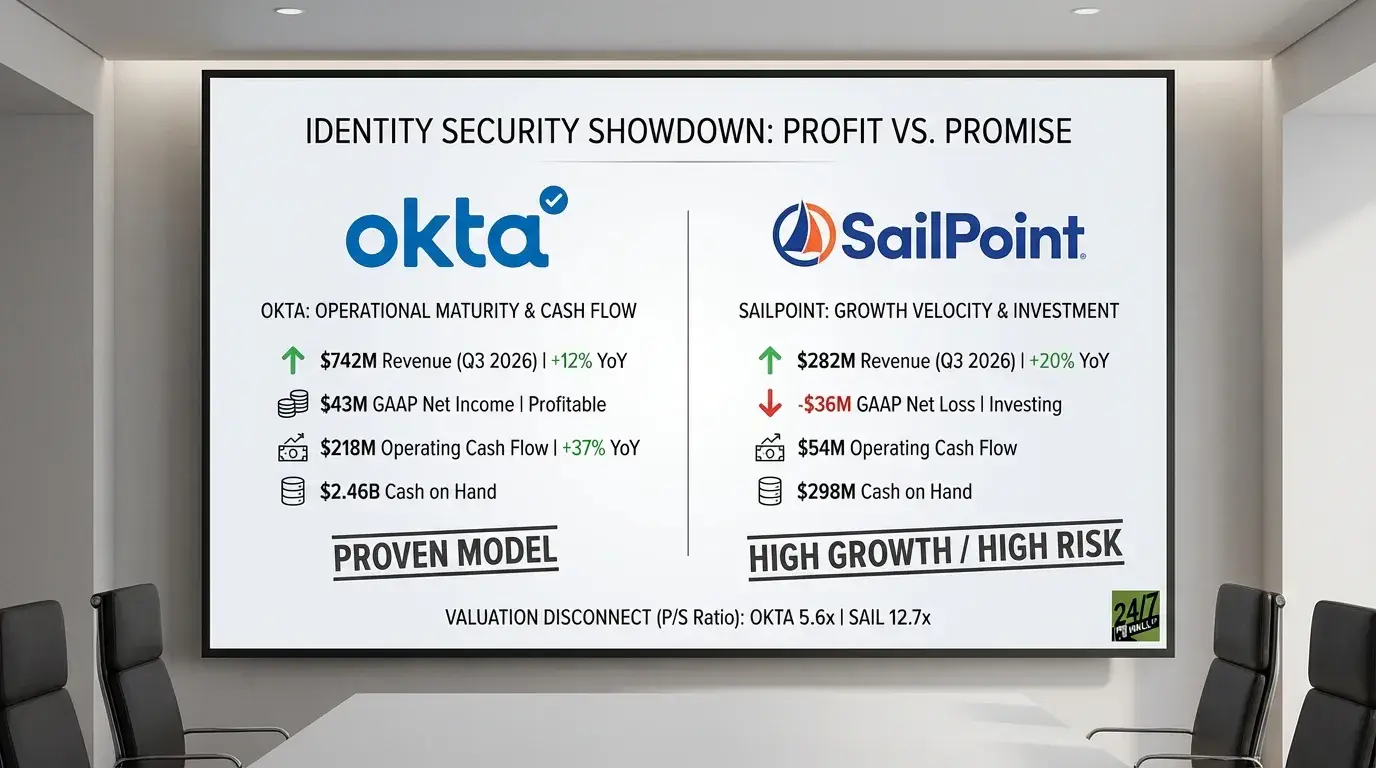

"Okta's quarter showed operational maturity. Revenue climbed 12% year over year, but operating cash flow surged 37% to $218 million. Free cash flow reached $211 million. The company turned a $16 million loss into $23 million in operating income. CEO Todd McKinnon highlighted "continued strength with large customers" and adoption of Okta Identity Governance and Auth0 for AI Agents. Large enterprise deals carry higher margins and stickier retention."

"SailPoint grew faster at 20% revenue growth and 38% SaaS ARR expansion. The company crossed $1 billion in total ARR, a milestone CEO Mark McClain called proof of "the strength of SailPoint's strategy and the durability of our business." But SailPoint's GAAP operating loss widened to $42 million from $24 million a year earlier. The company reports a 20% adjusted operating margin, but that requires adding back $98 million in stock compensation and other expenses. Okta doesn't need those adjustments to show profit."

"Okta operates at nearly three times SailPoint's revenue scale and generates four times the operating cash flow. That gap matters when both companies need to fund AI product development and compete for the same enterprise identity security budgets. Okta's $2.46 billion cash position provides room to invest aggressively or weather margin pressure. SailPoint's $298 million in cash leaves less margin for error, especially with a price-to-sales ratio of 12.7x compared to Okta's 5.6x."

Okta reported $742 million in revenue and $43 million in GAAP net income, with 12% year-over-year revenue growth and operating cash flow up 37% to $218 million. The company converted a $16 million loss into $23 million in operating income and cited strong large-customer demand plus adoption of Identity Governance and Auth0 for AI agents. SailPoint posted $282 million in revenue and a $36 million GAAP loss while growing revenue 20% and SaaS ARR 38%, crossing $1 billion in ARR. SailPoint's GAAP operating loss widened to $42 million and its 20% adjusted operating margin requires adding back $98 million in stock compensation and other expenses. Okta's larger scale, stronger cash generation, and $2.46 billion cash position contrast with SailPoint's $298 million cash, contributing to a valuation gap that reflects different market expectations.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]