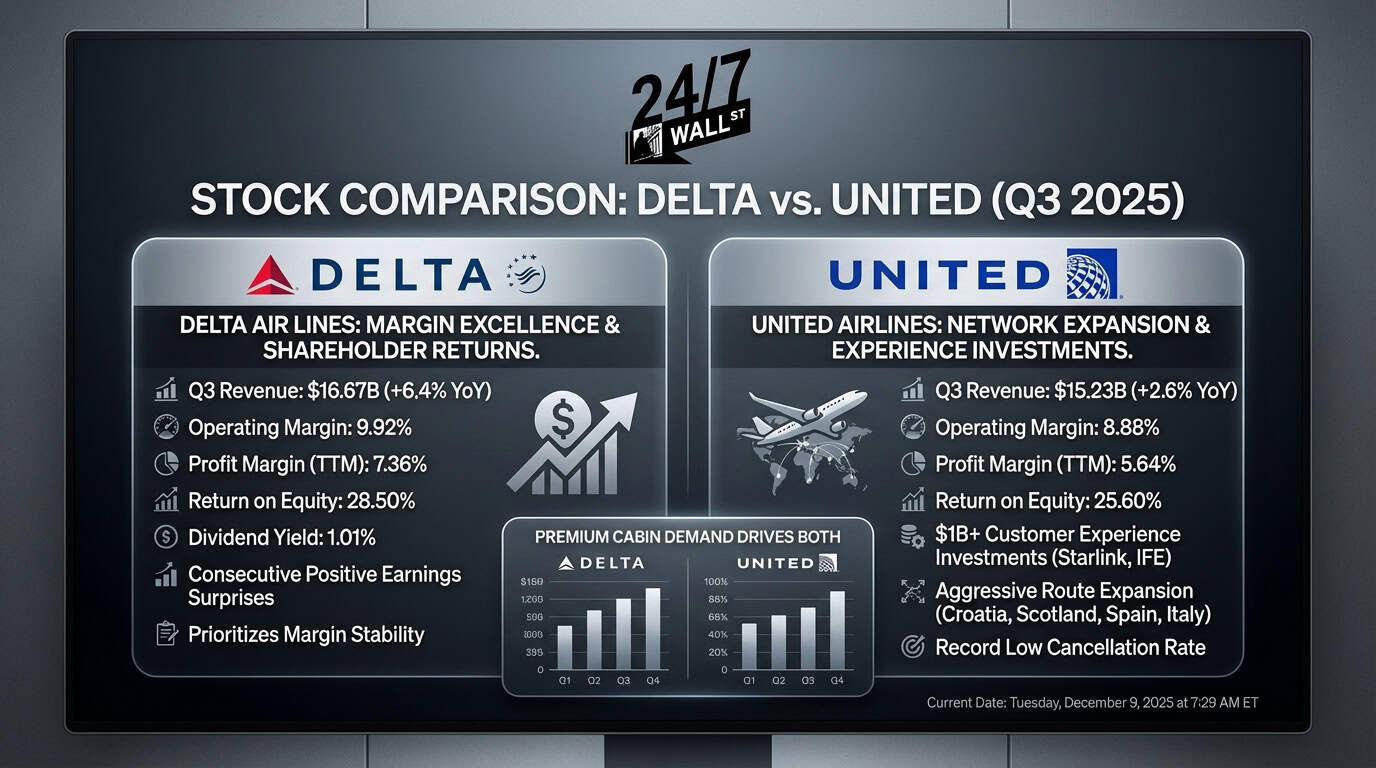

"United reported Q3 revenue of $15.23 billion, missing estimates of $15.29 billion but growing 2.6% year over year. Premium cabin revenue jumped 6% while basic economy climbed 4%. Cargo rose 3% and the loyalty program expanded 9%. Net income of $949 million declined 1.7% from the prior year, and adjusted EPS of $2.78 beat estimates of $2.67 by 4.1%. CEO Scott Kirby highlighted investments exceeding $1 billion in customer experience, including Starlink installations and enhanced inflight entertainment."

"Delta generated Q3 revenue of $16.67 billion, up 6.4% year over year, with net income of $1.42 billion and operating margin of 9.92%. EPS of $1.71 beat estimates of $1.53 by 11.8%, marking the third consecutive quarter of positive surprises. Delta's trailing twelve-month profit margin of 7.36% exceeded United's 5.64% by 172 basis points. Delta pays a dividend yielding 1.01% and maintains disciplined capital allocation."

Delta delivered strong Q3 results with $16.67 billion revenue, $1.42 billion net income, a 9.92% operating margin, and EPS of $1.71 that beat estimates by 11.8%. Delta's trailing twelve-month profit margin was 7.36%, outpacing United by 172 basis points. United posted $15.23 billion revenue with premium cabin revenue up 6%, loyalty growth of 9%, and adjusted EPS of $2.78 that beat estimates despite a 1.7% net income decline. United invested over $1 billion in customer experience, launched new international routes, and recorded a record low Q3 cancellation rate. Delta returned capital via dividends and disciplined allocation, while United focused capital on growth and trades at a lower forward P/E.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]