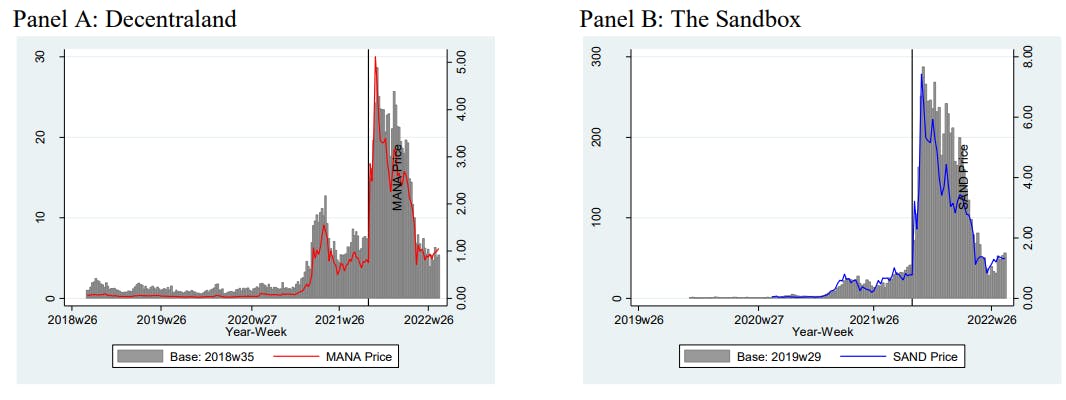

"The VAR Granger causality test reveals a lead-lag relationship between cryptocurrency and LAND prices, showing that cryptocurrency prices lead LAND prices consistently with significant p-values."

"The analysis indicates a strong correlation between cryptocurrency prices, particularly BTC and ETH, and LAND prices, with significant relationships observed in the first-differenced weekly data."

"The study aligns with previous findings that equity market returns have a positive relationship with the art market, highlighting similar effects within the cryptocurrency and LAND contexts."

"Correlation analysis notes that while LAND prices are affected by cryptocurrencies, particularly Decentraland and The Sandbox, the causation flows predominantly from cryptocurrency to LAND."

The VAR Granger causality test demonstrates a significant lead-lag relationship whereby cryptocurrency prices consistently lead LAND prices. Summary statistics show that while first-differenced correlations of cryptocurrency and LAND prices are lower, cryptocurrency remains highly correlated with LAND prices, especially Decentraland and The Sandbox. The inclusion of BTC and ETH in the analysis further supports the findings. Significant p-values confirm that the relationship supports the wealth effect hypothesis, paralleling historical observations of equity market influences on art market indices.

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]