"A 2025 NBER/NYU study revealed that retail investors spend just six minutes researching a stock before buying, often relying on price charts rather than fundamentals - a critical gap that leaves everyday investors at a severe disadvantage. While retail traders can now trade commission-free, they're making decisions with consumer-grade information while institutions access research and data costing millions. Moby bridges this divide by delivering institutional-quality investing insights through an AI-powered platform that translates complex financial data into clear, actionable intelligence."

"The platform serves investors across 70+ countries with over 1,000 market-beating reports, nearly 100K monthly app users, and 300K freemium subscribers, combining Wall Street-grade research with consumer-first design that respects both time and intelligence. Beyond empowering retail investors, Moby is expanding into B2B2C partnerships with banks, brokerages, and fintech platforms while developing portfolio-linking features and personalized AI-generated insights across all markets and asset classes."

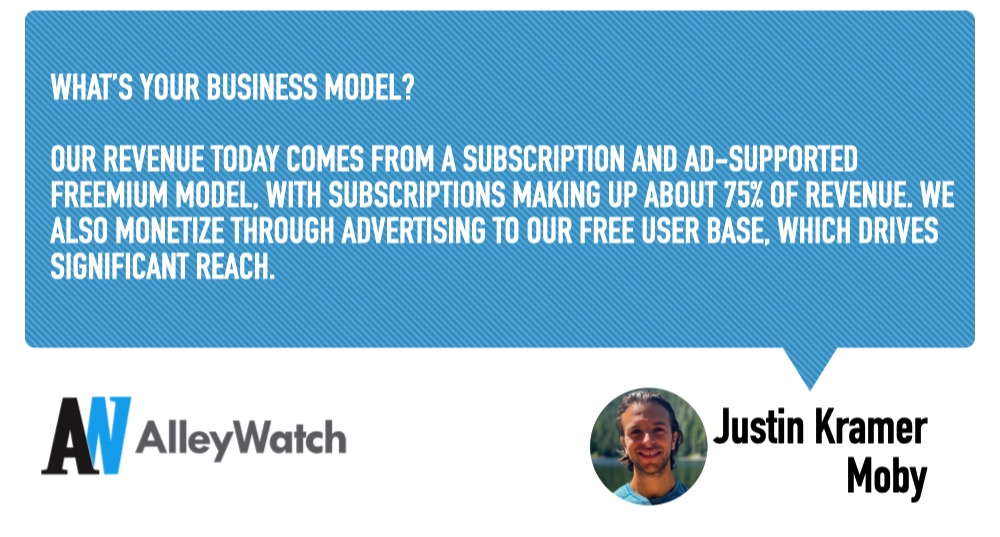

Retail investors typically research stocks for only six minutes and often rely on price charts instead of fundamentals, creating a competitive disadvantage versus institutions. Moby provides institutional-quality investment research via an AI-powered platform that translates complex financial data into concise, actionable intelligence. The platform serves users in 70+ countries, publishes over 1,000 reports, and reaches nearly 100K monthly app users plus 300K freemium subscribers. Moby recently closed a $5M seed led by IA Capital, bringing total funding to $6.3M. The company is pursuing B2B2C partnerships and building portfolio-linking and personalized AI-generated insights across markets and asset classes.

Read at Alleywatch

Unable to calculate read time

Collection

[

|

...

]