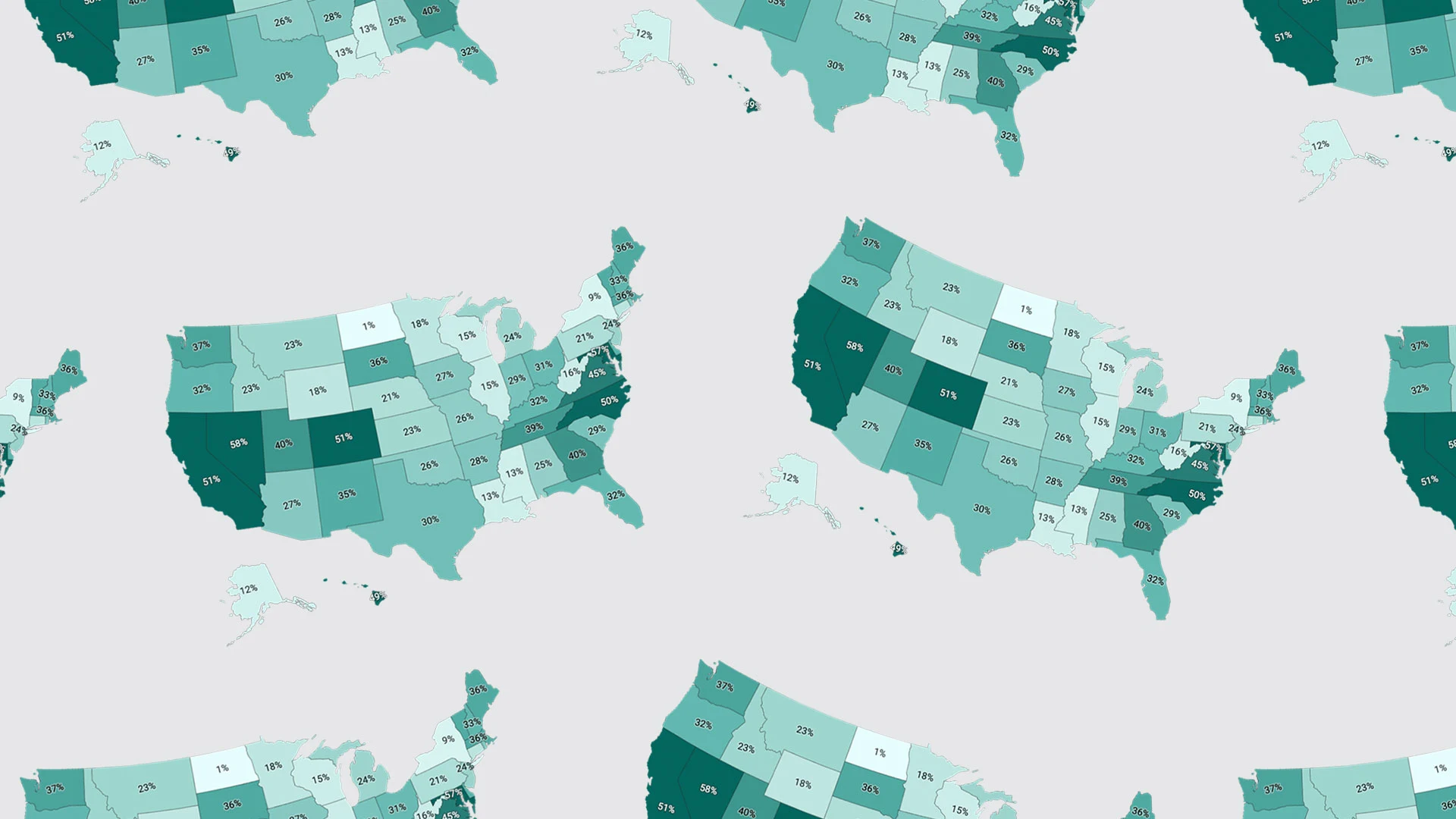

"ResiClub identifies that a rise in active home listings can signal potential pricing weakness, while a decrease suggests a strengthening market."

"Local housing markets with increased inventory above pre-pandemic levels have generally seen slower home price growth or price declines over three years."

ResiClub explores the correlation between housing inventory levels and home price trends. An increase in active listings, accompanied by longer market durations, indicates pricing weakness, whereas declining inventory suggests a hot market. Markets with inventory surpassing pre-pandemic levels have seen slower price growth, while those below have shown resilience. As summer approaches, national inventory is expected to near 2019 levels by late 2025. Current data shows a significant rise in listings, shifting more regions from seller to buyer markets.

Read at Fast Company

Unable to calculate read time

Collection

[

|

...

]