"QR payments are extremely intuitive. A business shows a QR code that links to a payment page. The customer scans it with their phone, checks the amount, and approves the payment. Businesses don't need either hardware or terminals. Across Europe, the adoption is surging. The market was worth around $1.6bn in 2021 and is expected to reach $2.3bn by the end of 2025. Surveys also show that QR codes are being used for both card and account-to-account payments, helping businesses bridge online and in-store checkouts."

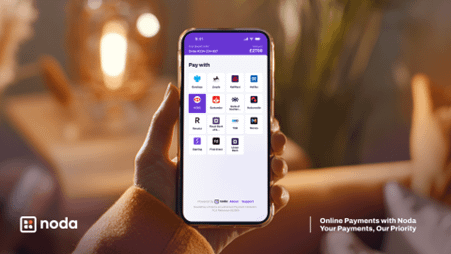

"Noda is an open banking provider, which was founded in 2018 with the help of investor Dmitry Volkov, who invested in 2020. However, in 2023 he divested his stake, so since then the Noda Volkov relationship has ended. The company has been helping merchants in the UK and globally to simplify payments. One of their recent developments is offering QR payments for in-store merchants. Their open banking network connects to over 2,000 banks."

Physical retail payments are shifting rapidly toward QR-based, contactless methods that require no hardware or terminals. QR payments let customers scan a code, confirm an amount, and approve payment via their phone, supporting both card and account-to-account flows. Adoption surged during Covid-19 and continues across Europe, with market value growing from about $1.6bn in 2021 toward $2.3bn by 2025. Pay-by-bank options bypass card networks and lower fees by routing payments through banking apps. Noda, an open-banking provider founded in 2018, offers QR pay-by-bank solutions and connects to over 2,000 banks to support merchants.

Read at London Business News | Londonlovesbusiness.com

Unable to calculate read time

Collection

[

|

...

]