"The Beat Threshold: A meaningful beat requires EPS of at least $3.36 (1.5% above consensus) paired with revenue of $3.35 billion or higher. The company's average surprise over the past eight quarters is 1.2%. Historical Context: NXP has beaten or met earnings estimates in 10 of the past 11 quarters, with only Q3 2025 showing a minor miss of $0.01."

"3 Key Takeaways from Q3 2025: Revenue of $3.17 billion declined 2.4% year-over-year but improved 8.5% sequentially, signaling potential stabilization. Operating margin compressed to 28.1% from 30.5% in Q3 2024, though gross margin held steady at 56.3%. Automotive segment grew to $1.84 billion while Industrial/IoT reached $579 million, both up 6% quarter-over-quarter. Management's Promise: Last quarter, management guided Q4 revenue to $3.20-3.40 billion, implying potential sequential growth."

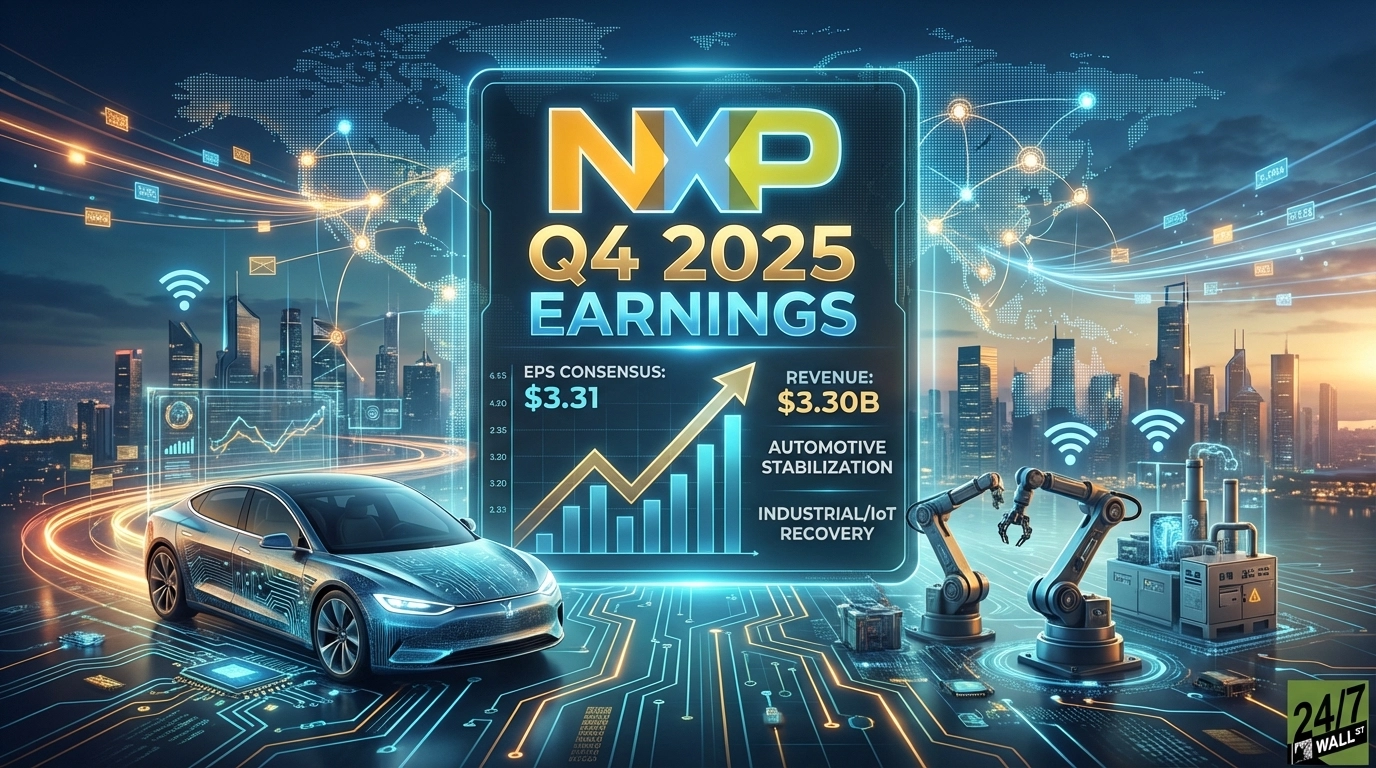

NXP Semiconductors is scheduled to report Q4 2025 results after market close, with Wall Street consensus at $3.31 EPS on $3.30 billion revenue, implying modest year-over-year growth. Analysts expect automotive stabilization and Industrial/IoT recovery after 6% sequential gains in Q3. A meaningful beat is defined as at least $3.36 EPS and $3.35 billion revenue, compared with an average surprise of 1.2% over eight quarters. NXP has met or beaten estimates in 10 of the last 11 quarters. Q3 showed sequential improvement with revenue of $3.17 billion, margins mixed, completion of a MEMS sensors sale, and acquisition of Aviva Links.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]