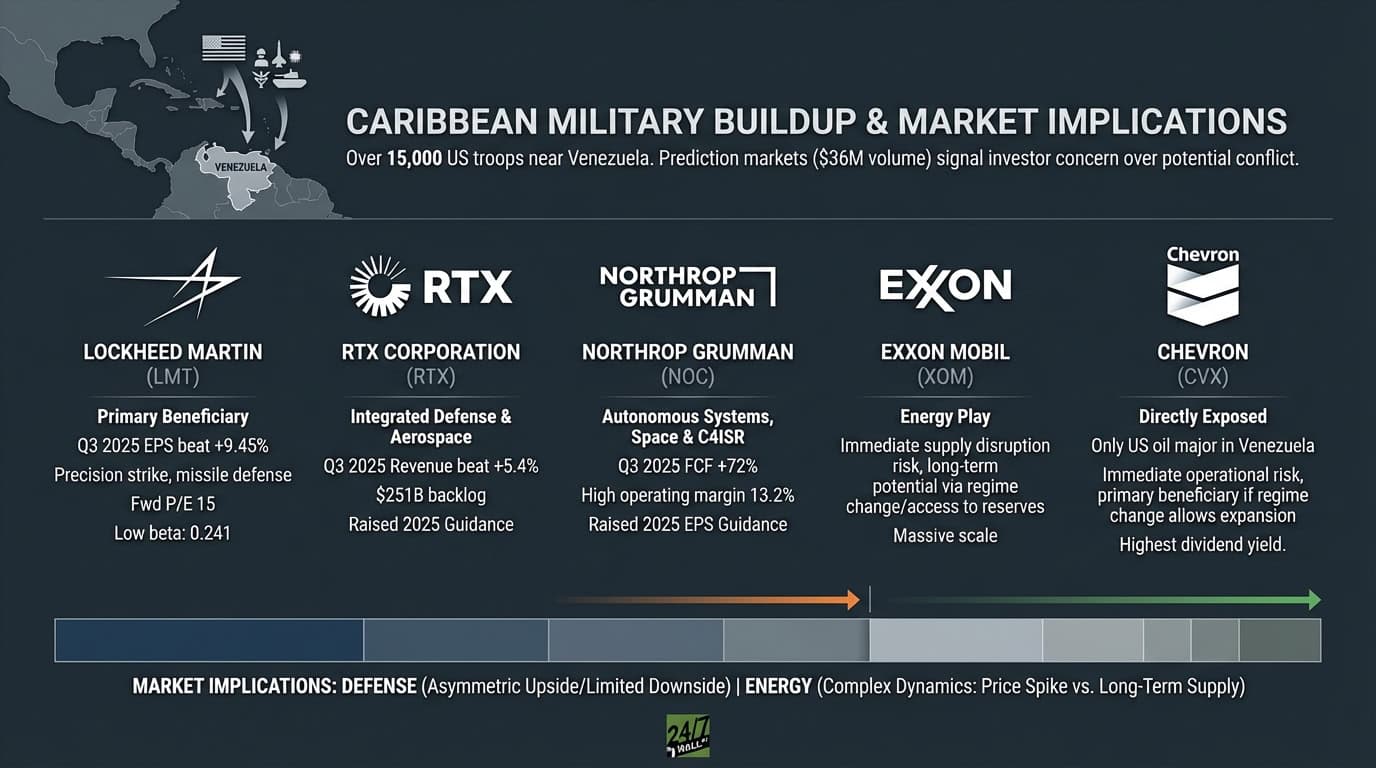

"The United States has assembled its largest military presence in the Caribbean since 1989, with more than 15,000 troops deployed near Venezuela. Following the December 10 seizure of a Venezuelan oil tanker and ongoing strikes on alleged drug-smuggling boats, $36 million in trading volume on prediction markets tracking US-Venezuela military engagement signals serious investor concern about potential armed conflict."

"Lockheed Martin stands as the primary beneficiary of any Venezuela military engagement. The company's $109.2 billion market cap and specialization in precision strike missiles, military aircraft, and missile defense systems position it directly for contract expansions during regional conflicts. LMT beat Q3 2025 earnings estimates by 9.45%, delivering $6.95 per share against expectations of $6.35. Revenue reached $18.61 billion with an 11.7% operating margin. The company has beaten earnings in seven of the last eight quarters with an average surprise of 8.9%."

The United States has deployed over 15,000 troops near Venezuela, marking the largest Caribbean military presence since 1989. A December 10 oil tanker seizure and strikes on alleged drug-smuggling boats coincided with $36 million traded on prediction markets tracking US-Venezuela engagement, indicating strong investor concern about potential armed conflict. A military confrontation would benefit defense contractors through increased equipment demand and contracts, while energy companies could see immediate oil price spikes and potential long-term supply changes if regime change occurs. Lockheed Martin appears positioned to gain, with a $109.2 billion market cap, recent earnings beats, strong margins, a forward P/E of 15, and a Wall Street price target implying upside.

#us-military-buildup #venezuela-tensions #defense-contractors #energy-market-volatility #lockheed-martin

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]