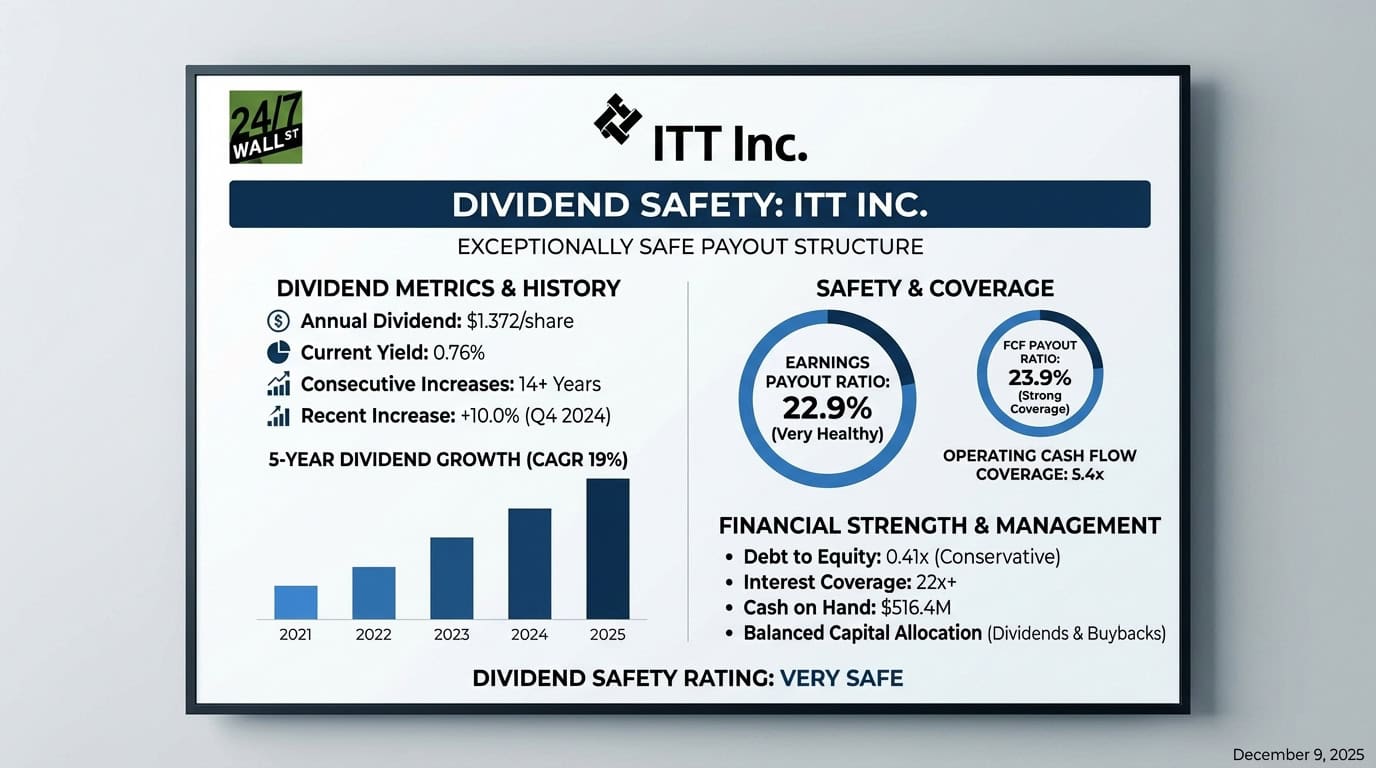

"ITT Inc ( NYSE: ITT) pays a modest dividend that won't excite income investors chasing yield, but the numbers behind it tell a story of exceptional safety. With a 0.76% yield and $1.372 in annual dividends per share, this industrial manufacturer has built one of the most conservative payout structures in its sector. ITT's dividend safety starts with remarkably low payout ratios. The company earned $5.99 per share over the trailing twelve months while paying just $1.372 in dividends,"

"In 2024, ITT generated $438.2 million in free cash flow (operating cash flow of $562.1 million minus capital expenditures of $123.9 million) and paid $104.7 million in dividends. That's a free cash flow payout ratio of just 23.9%, giving the company 4.2 times coverage of its dividend obligations. These ratios remained stable even as ITT grew the dividend at a 19% compound annual rate over the past five years."

"ITT carries $1.084 billion in total debt against $2.665 billion in shareholders' equity, producing a debt to equity ratio of just 0.41x. With EBITDA of $815.3 million, the company generates more than enough cash flow to service its obligations comfortably. Interest expense ran just $36.6 million in 2024, giving ITT an interest coverage ratio exceeding 22 times. Even if earnings fell by half, the company could easily cover its debt service and maintain the dividend."

ITT pays a 0.76% dividend of $1.372 per share while earning $5.99 per share over the trailing twelve months, a 22.9% earnings payout ratio. Free cash flow was $438.2 million in 2024 (operating cash flow $562.1 million minus $123.9 million in capital expenditures), and dividends paid were $104.7 million, a 23.9% free cash flow payout ratio with 4.2x coverage. The company grew dividends at a 19% compound annual rate over five years and raised the quarterly payout by 10% in early 2025. Total debt is $1.084 billion versus $2.665 billion in equity (0.41x), EBITDA $815.3 million, and interest expense $36.6 million, giving interest coverage above 22x. Net income fell to $72.5 million in 2020 and rebounded to $518.3 million by 2024. The dividend has risen annually for over 14 years without a cut.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]