#leverage

#leverage

[ follow ]

#risk-management #market-volatility #bitcoin #margin-trading #free-cash-flow #gold #microstrategy #forex-trading

fromEntrepreneur

1 week agoFree Webinar | February 24: How Founders Can Use AI to Work Less & Make More Money

Feeling overwhelmed isn't a time-management problem - it's a leverage problem. But understanding smart AI strategies can get you out of the weeds and back to focusing on the kind of work that actually helps your business grow. You'll learn how to turn AI into an invisible team working behind the scenes to support your business without adding more tools, noise or complexity.

Growth hacking

fromAol

1 week agoCACI (CACI) Q2 2026 Earnings Call Transcript

Revenue -- $2.2 billion, representing 5.7% year-over-year growth and 4.5% organic growth in the second quarter. EBITDA margin -- 11.8% for the quarter, a 70 basis point year-over-year increase, aided by strong program execution and favorable technology mix. Adjusted diluted EPS -- $6.81, up 14% from the prior year, reflecting higher operating income and a lower share count. Free cash flow -- $138 million in the quarter, with day sales outstanding at 57 days.

Business

Cryptocurrency

fromThe Mercury News

1 month agoThe 11 big trades of 2025: Bubbles, cockroaches and a 367% jump

Investors placed high-conviction, leveraged bets across crypto, bonds, stocks and currencies in 2025, producing outsized gains, abrupt reversals, and renewed concern over valuation and leverage.

fromLondon Business News | Londonlovesbusiness.com

1 month agoForex vs CFD trading: A comprehensive comparison - London Business News | Londonlovesbusiness.com

The primary advantage of forex trading is its exceptional liquidity, which allows traders to enter and exit positions quickly without significant price slippage. Transaction costs are typically lower due to tight bid-ask spreads, especially for major currency pairs. Additionally, forex markets are heavily regulated in most countries, providing traders with better consumer protection. The standardized nature of currency pairs makes it easier to develop consistent trading strategies across different market conditions.

Business

fromThe New Yorker

1 month agoWhat Happens When an "Infinite-Money Machine" Unravels

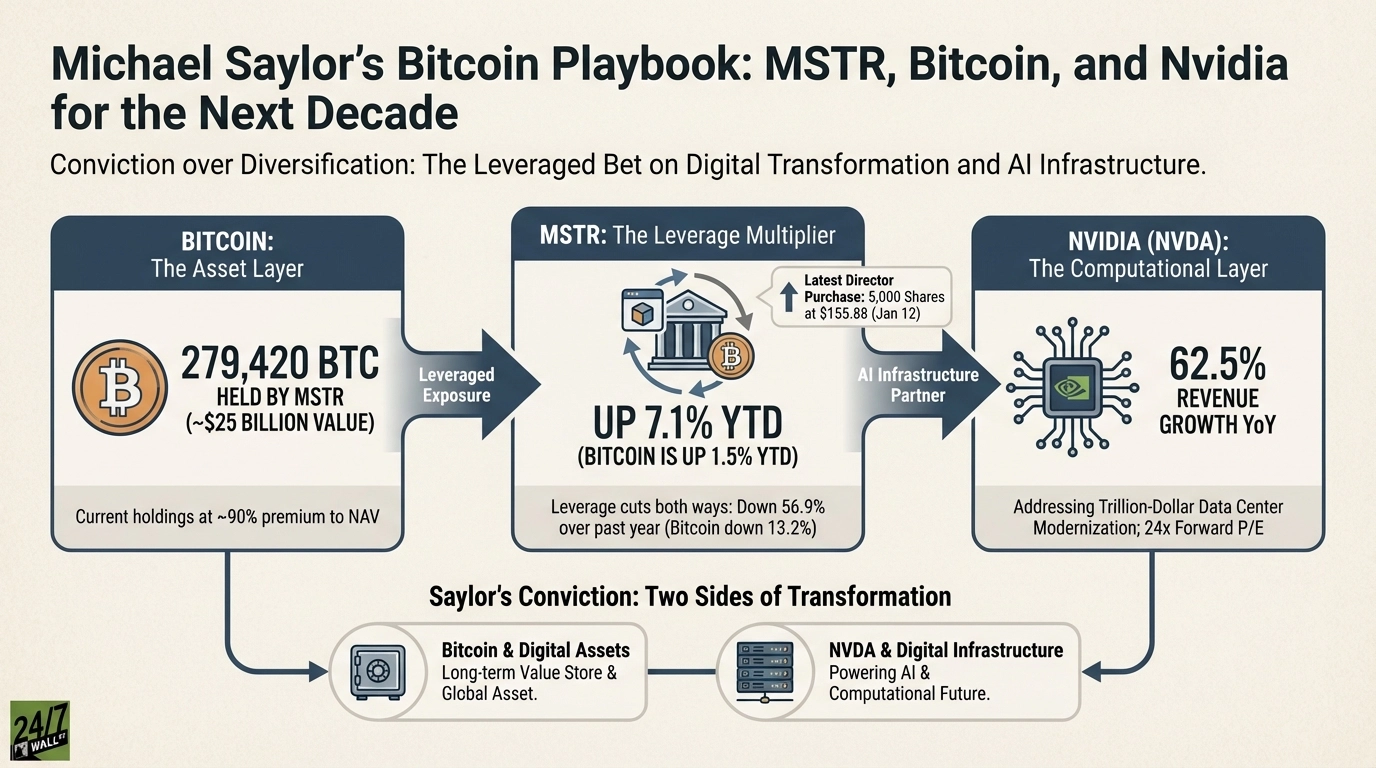

The price of bitcoin, which more than doubled last year in a trend that many attributed to the "Trump trade," obviously played a big role in this alchemy, but there was also another factor-one that did seem a little magical, or insane, depending on your viewpoint. As MicroStrategy expanded its purchases, eventually accumulating more than three per cent of all the bitcoins in existence, its purchases helped drive the price of the digital currency higher.

Business

from24/7 Wall St.

1 month agoWaste Management's 1.51% Yield Is Safe With a 56% Payout Ratio and Growing Cash Flow

Waste Management paid $1.21 billion in dividends against $2.16 billion in free cash flow during 2024, producing a 56.0% FCF payout ratio. That leaves nearly $950 million in retained cash after dividends. The trailing earnings payout ratio sits at 50.9% ($3.225 divided by $6.34 EPS). Over eight years, the FCF payout ratio averaged 49.4%, ranging from 39.8% in 2021 to 62.3% in 2023. Operating cash flow surged 69% from $3.18 billion in 2017 to $5.39 billion in 2024.

Business

fromGREY Journal

2 months agoThe Mindset Shift Every Entrepreneur Needs to Win in 2026

Entrepreneurship is entering a new era-one defined not by hustle culture, but by clarity, systems, and smart leverage.In 2026, the entrepreneurs who win won't be the ones grinding the longest hours. They'll be the ones who think strategically, adapt quickly, communicate clearly, and build businesses that function even when they step away. Here's the mindset shift every founder needs before stepping into the next year.

Startup companies

fromThe New Yorker

2 months agoAndrew Ross Sorkin on What 1929 Teaches Us About 2025

When President Donald Trump began his tariff rollout, the business world predicted that his unprecedented attempt to reshape the economy would lead to a major recession, if he went through with it all. But the markets stabilized and, in recent months, have continued to surge. That has some people worried about an even bigger threat: that overinvestment in artificial intelligence is creating a bubble.

Artificial intelligence

fromwww.housingwire.com

4 months agoCrossCountry Mortgage closes $900M debt issuance

Fitch cited CCM's strong market share in the distributed retail channel, solid operating track record, experienced management team and conservative leverage as credit strengths. The company ranked as the eighth-largest lender in the first half of 2025, with $23.05 billion in originations, according to Inside Mortgage Finance. But Fitch also flagged challenges, including exposure to cyclical mortgage market conditions, reliance on secured short-term wholesale funding, regulatory risk tied to Ginnie Mae loans and key personnel risk related to majority shareholder Ron Leonhardt.

Business

fromBusiness Matters

5 months agoMastering Gold Futures: Key Strategies, Risks, and Opportunities

It was always much more than just a precious metal. It's a secure haven in turbulent times, a trade instrument, and also an emblem of prosperity. A favorite among institutional investors, portfolio managers as well as retail investors is gold futures. They let you benefit from price fluctuations and protect against the effects of inflation. Before you begin, it is important to be aware of how gold futures work as well as the risk involved and the strategies you can employ to remain ahead.

Business

fromAbove the Law

5 months agoPaul Weiss & Kirkland Doing Free Trump Commerce Department Work As Part Of 'Please Don't Hurt Us, Daddy' Deals - Above the Law

Ever since the Surrendergate Nine capitulated to the Trump administration, pledging nearly a billion dollars worth of free legal work, the firms have bent over backward to shrug it off as no big deal. As the months dragged on, and the firms lost more talent and more clients, stories started cropping up suggesting that the firms viewed the deals as unenforceable all along and that it's business as usual over there.

US politics

Cryptocurrency

fromLondon Business News | Londonlovesbusiness.com

5 months agoCryptocurrencies continue to decline amid deleveraging after recent gains - London Business News | Londonlovesbusiness.com

Bitcoin and altcoins face significant declines due to inflation concerns and leveraged market positions.

[ Load more ]