"SOXS doesn't hold semiconductor stocks or collect dividends from companies like NVIDIA ( NASDAQ:NVDA) or Advanced Micro Devices ( NASDAQ:AMD). Instead, the fund uses derivatives including swaps and futures to achieve -3x daily exposure to the ICE Semiconductor Index. Approximately 66% of the fund's $1.1 billion in assets sits in cash collateral, primarily Goldman Sachs ( NYSE:GS) Treasury Instruments, generating interest income. Additional distributions come from gains when semiconductor stocks decline and the fund profits from short positions."

"SOXS distributions are highly unstable because they depend on two volatile factors: interest rates on cash collateral and gains from semiconductor stock declines. When semiconductors rally, as they have throughout 2025, the fund generates minimal profits from short positions while experiencing severe price decay from daily rebalancing costs. The fund's 0.97% expense ratio and daily reset mechanism create structural headwinds."

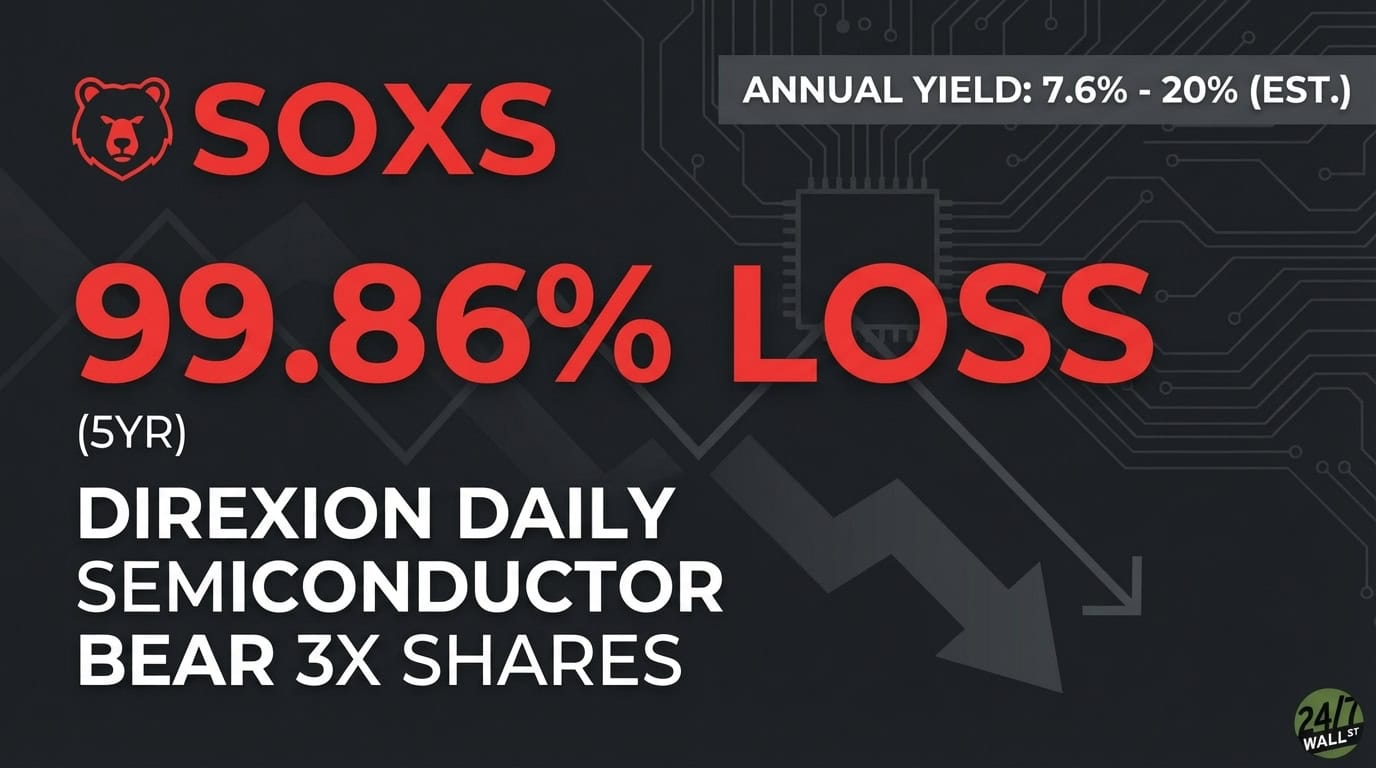

SOXS targets -3x daily inverse performance to the ICE Semiconductor Index by using derivatives such as swaps and futures rather than owning semiconductor stocks. Roughly 66% of its $1.1 billion assets are held as cash collateral in Goldman Sachs Treasury instruments, which generates interest income that contributes to distributions. Additional distributions arise when short positions profit from semiconductor declines. Distributions are volatile and hinge on cash interest rates and short gains. Daily rebalancing, the 0.97% expense ratio, and prolonged semiconductor rallies have caused severe price decay; SOXS declined 87% year-to-date in 2025 and 99.86% over five years.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]