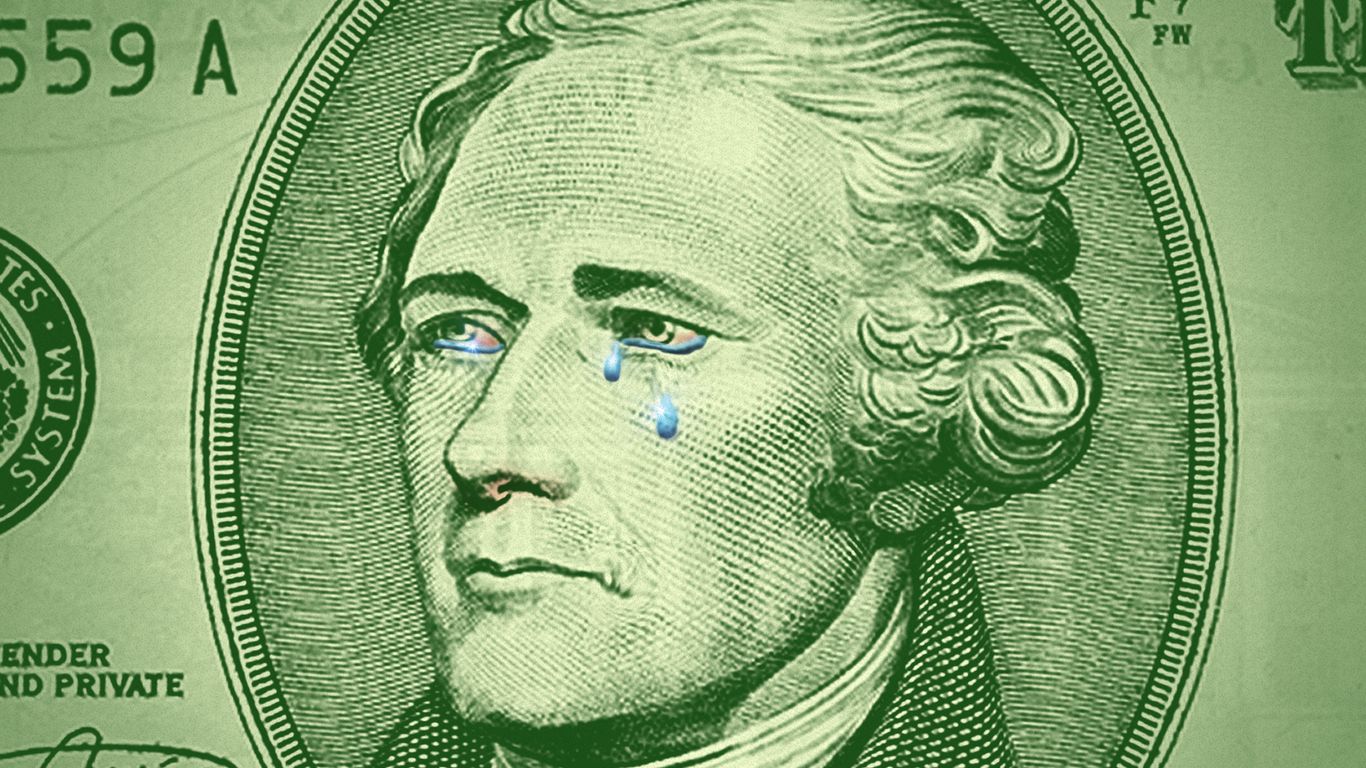

""Policy-induced uncertainty is driving de-dollarization... it could result in a Jimmy Carter moment where we end up in stagflation.""

""As uncertainty drives dollar declines, that also impacts other parts of the market and the economy.""

""Dollar weakness could steepen the yield curve, leading to higher borrowing costs for corporates and households.""

""There is no real alternative to the dollar, so investors can only reduce their overweights to the greenback very gradually.""

Mass de-dollarization poses significant risks to the dollar and can negatively impact the stock market. Driven by policy-induced uncertainty, there's concern it may lead to stagflation akin to a 'Jimmy Carter moment.' As the dollar declines, other economic areas are also affected, with potential increases in borrowing costs. While there may be a gradual move away from dollar assets, there remains no viable alternative. Recent dollar weakness follows a bull run and underscores the importance of global diversification in long-term investment strategies, particularly as valuations for U.S. equities appear stretched.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]