Public health

fromFortune

5 hours agoRo CEO wants to erase GLP-1 stigma with first Super Bowl ad featuring Serena Williams | Fortune

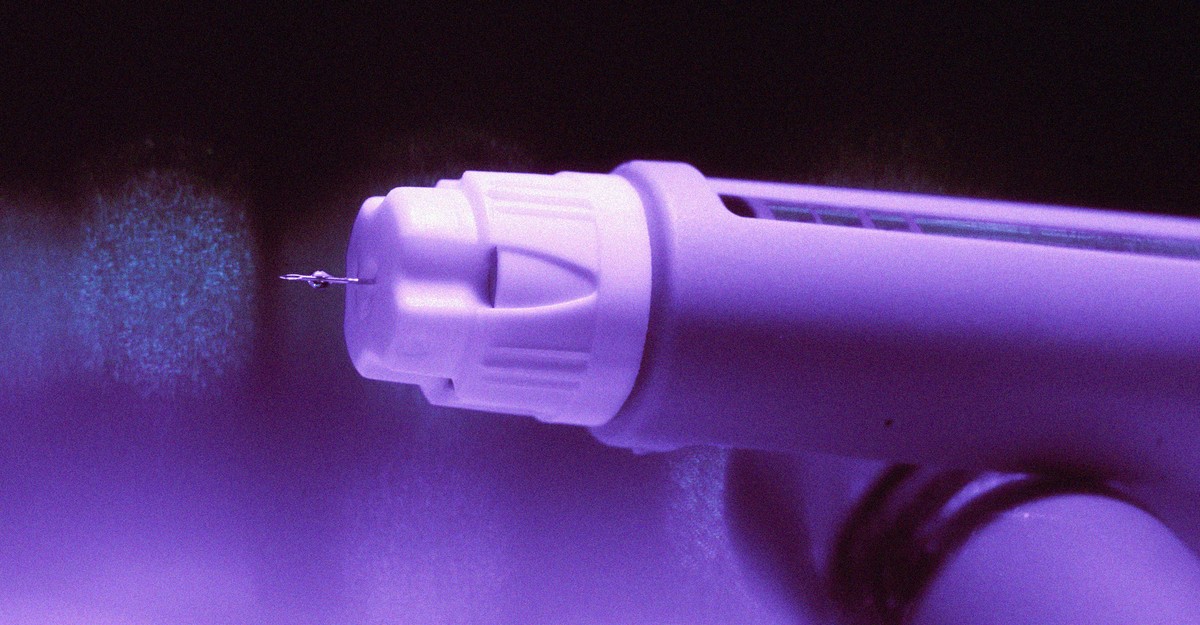

GLP-1 weight-loss drugs are becoming central to wellness marketing, promoted as lifelong health tools, driving demand, advertising campaigns, and policy and cost challenges.