Real estate

fromRedfin | Real Estate Tips for Home Buying, Selling & More

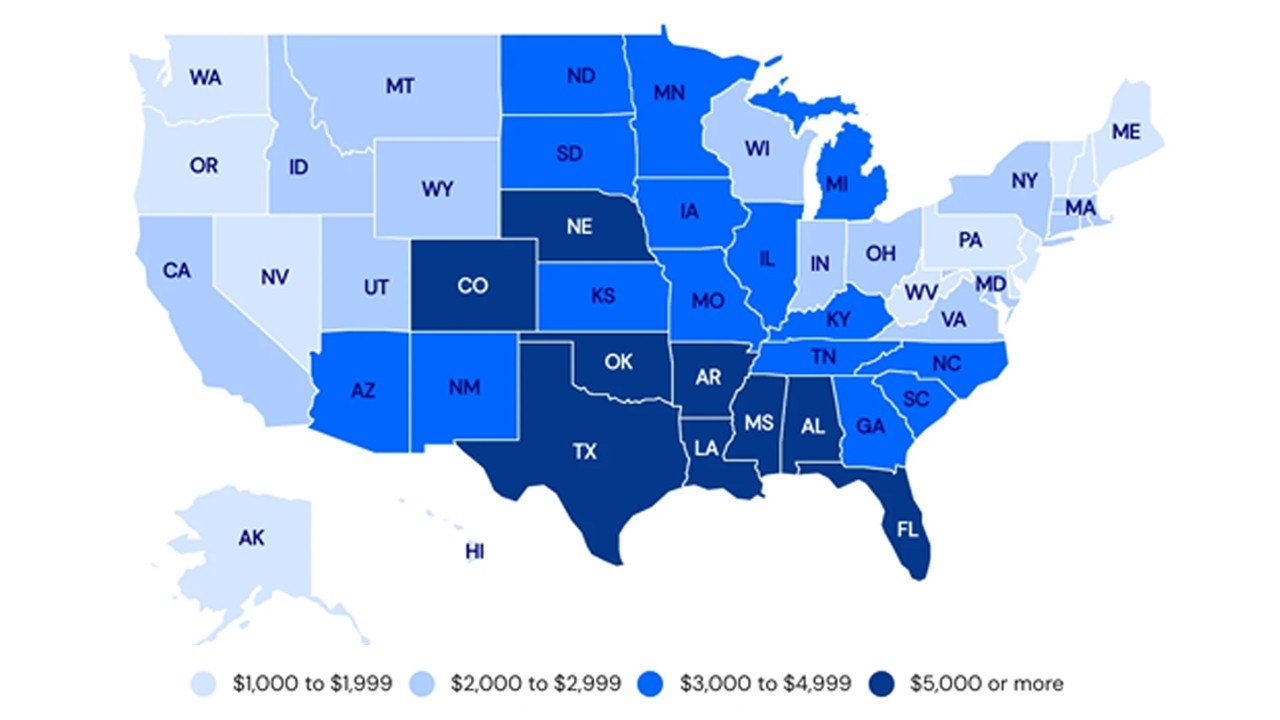

5 days agoHow Home Insurance is Calculated and Why Prices Can Vary So Much

Home insurance premiums are calculated from risk factors—property age, location, claim history, environmental hazards, and projected claim frequency and severity.