#insurance-premiums

#insurance-premiums

[ follow ]

fromwww.aljazeera.com

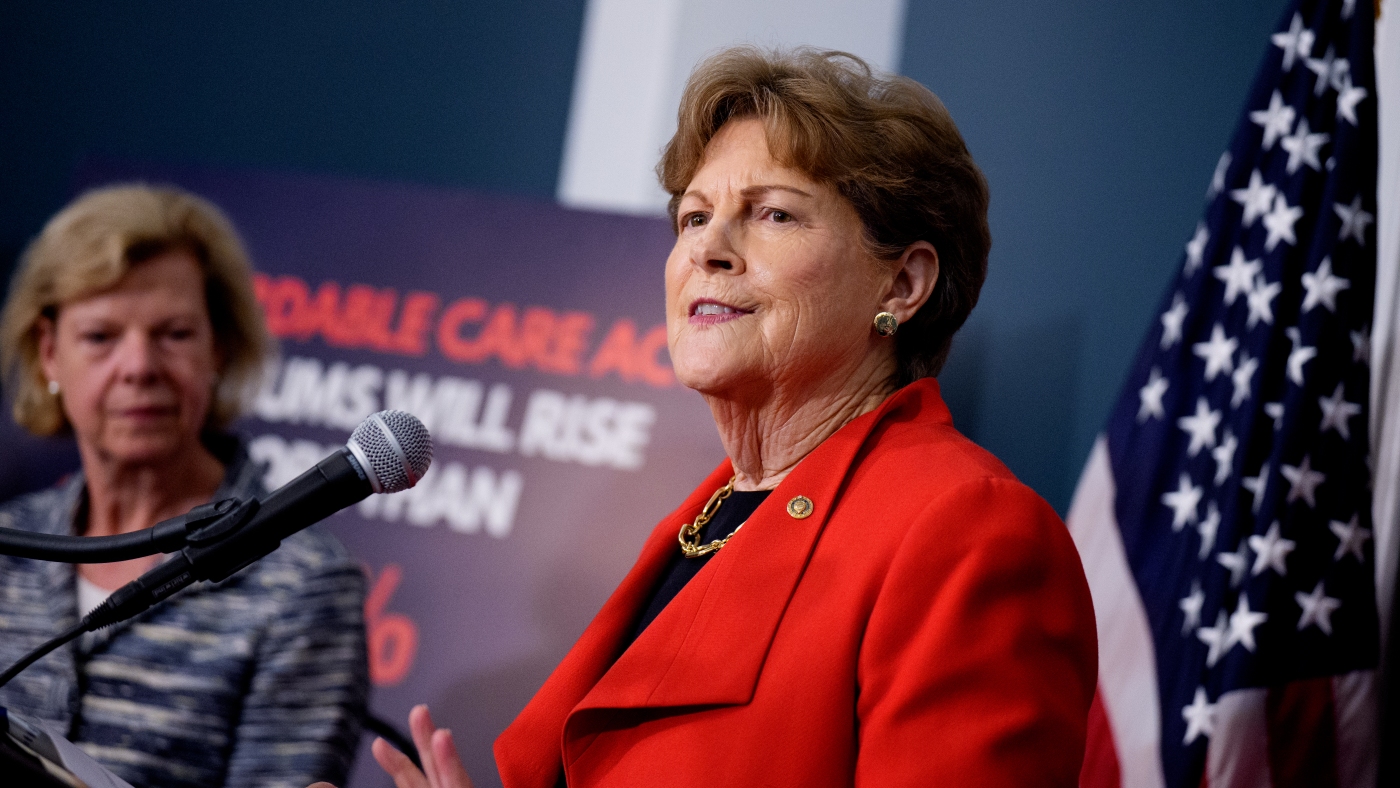

1 month agoFailure of rival health bills underscores impasse in US politics

Without the subsidies, premiums could more than double in cost on average, according to KFF, a health policy organisation. For some, like Nicole Sheaff, a mother of four in New Hampshire, her prices would quintuple. I'm terrified we won't be able to keep up with our mortgage. At the same time, going without health insurance is not an option. My husband has a chronic condition that he needs medication to manage, and he wouldn't be able to afford it without health coverage.

US politics

fromwww.cbc.ca

2 months agoAlberta already has sky-high car insurance rates. Will 120 km/h speed limits send premiums higher? | CBC News

Vehicle insurance companies are going to keep a close watch on whether the Alberta government keeps driving forward with a proposal to increase some highway speed limits to 120 km/h. The province has launched an online survey about increasing the speed limit on upwards of 2,150 kilometres of divided highways in different parts of Alberta. The survey also asks which of the highways should be prioritized for faster speeds. The government plans to begin a trial after the survey closes on Dec. 12.

Canada news

fromSFGATE

4 months agoMissouri Insurance Costs Fall in the Middle of the Pack, But Severe Weather Threats Loom

Missouri homeowners face mid-range insurance premiums compared with both their regional neighbors and the broader U.S. While not as high as storm-prone Gulf Coast states, Missouri's costs are higher than some nearby Midwestern states, reflecting its exposure to tornadoes, hail, and severe weather. Data from the U.S. Census Bureau and the Realtor.com® 2025 Climate Risk Report highlight Missouri's position in the national picture.

Environment

fromSFGATE

4 months agoMaine Homeowners Pay Some of the Lowest Insurance Costs In The Country

Maine has 451,090 insured homeowner households in total-250,316 with a mortgage and 200,774 without. Among mortgaged owners, 22,458 pay less than $100 annually and 7,049 pay $4,000 or more. Among those without a mortgage, 37,135 pay less than $100 and 3,840 pay $4,000 or more. When compared with nearby New England states, Maine is clearly on the affordable side. Massachusetts homeowners with a mortgage typically pay $1,500-$1,999, while Rhode Island averages the same. Connecticut is also higher, at $1,500-$1,999 for mortgaged households.

Real estate

fromSFGATE

4 months agoAlaska Homeowners Pay Some of the Lowest Insurance Costs In The Country

According to newly released American Community Survey (ACS) data from the U.S. Census Bureau, Alaska homeowners with a mortgage typically pay $1,000-$1,499 a year for homeowner's insurance, while those without a mortgage pay $800-$999; overall costs fall in the $1,000-$1,499 range. At the extremes, Alaska has 182,292 insured homeowner households in total-110,175 with a mortgage and 72,117 without. Among mortgaged owners, 10,862 pay less than $100 annually and 6,473 pay $4,000 or more.

Environment

Cars

fromLondon Business News | Londonlovesbusiness.com

4 months agoCar finance and insurance: How to keep the costs under control in 2025 - London Business News | Londonlovesbusiness.com

Monthly car finance payments obscure additional costs like insurance, tax, servicing, and maintenance that can significantly increase total car ownership expenses.

fromwww.housingwire.com

4 months agoRising insurance costs deepen homeownership strain

Property insurance costs continue to be the fastest growing subcomponent of mortgage payments among existing homeowners, said Andy Walden, head of mortgage and housing market research at ICE Mortgage Technology. While mortgage principal, interest and property tax payments have all increased in recent years, insurance has far outpaced those gains, rising 4.9% in 2025, 11.3% annually and nearly 70% over the past five and a half years.

Real estate

Boston real estate

fromBoston Condos For Sale Ford Realty

5 months agoBoston Condo Insurance Premiums Are Soaring Boston Condos For Sale Ford Realty

Rising insurance premiums force associations to raise dues, levy assessments, or use reserves and credit, increasing financial strain and foreclosure risk for condo owners.

[ Load more ]