#tax-revenue

#tax-revenue

[ follow ]

#economic-impact #corporation-tax #shadow-economy #undeclared-work #minimum-wage #germany #data-centers

World news

fromenglish.elpais.com

1 month agoVenezuelan migrants contribute billions of dollars to Latin America, but continue to work in the informal sector

Venezuelan migrants in Latin America generated at least $10.6 billion and contribute significantly to tax revenue and economic growth in host countries.

fromwww.bbc.com

2 months agoUK economy growth forecasts lowered from next year

The UK economy is expected to grow at a slower rate than previously expected from next year, the government's official forecaster has said. The Office for Budget Responsibility (OBR), which maps out how the economy is set to perform based on the government's tax and spending policies, increased its growth expectations for this year, but downgraded its forecast for the following four.

UK news

fromwww.independent.co.uk

2 months agoBrexit costing UK up to 90bn in lost tax revenue , new analysis shows

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

UK politics

UK politics

fromLondon Business News | Londonlovesbusiness.com

3 months agoInheritance Tax Receipts raise 4.4 billion in six months - London Business News | Londonlovesbusiness.com

Inheritance Tax receipts rose to £4.4bn in the first half of 2025/26, and gifting-rule changes could be targeted to raise further revenue.

fromLondon Business News | Londonlovesbusiness.com

3 months agoReeves warned decreasing the VAT threshold in the Budget will increase inflation

The case for arguing that a significant cut to the VAT registration threshold will stimulate growth is far from clear cut. A sudden, material reduction in the current £90,000 VAT threshold would bring large numbers of small businesses into the scope of quite a complicated tax. The impact of higher prices on consumer spending is likely to hit business's profitability and in turn investment and employment.

UK politics

fromBusiness Matters

4 months agoReeves VAT bombshell: Small firms face 30,000 registration threshold in Budget shake-up

Small businesses are bracing for a major shake-up after it emerged the Treasury is considering slashing the VAT registration threshold from £90,000 to just £30,000. The move, reportedly under review ahead of the November 26 Budget, would pull tens of thousands of sole traders and small firms into the VAT system for the first time, forcing them to charge customers more and deal with additional red tape.

UK news

Higher education

fromInside Higher Ed | Higher Education News, Events and Jobs

4 months agoNew Report: Tribal Colleges Boost the Economy

Tribal colleges boost alumni wages, support tens of thousands of jobs, generate billions in economic output, returning more economic and tax value than federal investment.

fromwww.mercurynews.com

6 months agoAlbany leaders consider budget stabilizing measures as revenue falls short

The city has been experiencing a structural deficit, projected to peak at nearly $2 million in 2029 or $6 million in 2035 due to growing pension liabilities and unfunded capital projects.

Miscellaneous

fromIrish Independent

8 months agoSigns boom in corporation tax may be beginning to falter

Daryl Hanberry from Deloitte Ireland remarked that the increase in VAT indicates strong employment and consumer spending, emphasizing the need for further investment to support the growing population.

UK politics

fromwww.theguardian.com

8 months agoLib Dems claim deeper trade deal with EU would raise 25bn of tax revenue

The party is writing to all Labour MPs this week asking them to join forces in a push for a much more comprehensive deal with Brussels, arguing that this would help revive the public finances.

UK politics

fromComputerWeekly.com

9 months agoHMRC predicts IR35-related 20m annual tax loss due to business size classification changes | Computer Weekly

The UK government's new company classification thresholds will cost the Treasury around £20m annually in lost tax revenue due to IR35 non-compliance, impacting thousands.

UK politics

fromSlate Magazine

9 months agoTrump's Weaponized IRS

On April 7, the Treasury Department and Department of Homeland Security reached an agreement to allow ICE to utilize confidential tax information to locate undocumented immigrants. Advocates express concern that this collaboration may threaten the estimated $66 billion in federal tax revenue contributed by undocumented immigrants, as it could instill fear among these communities. The implications of this agreement not only remain legally questionable but may also deter undocumented individuals from filing taxes, ultimately affecting federal revenue streams.

Podcast

Silicon Valley real estate

fromThesanjoseblog

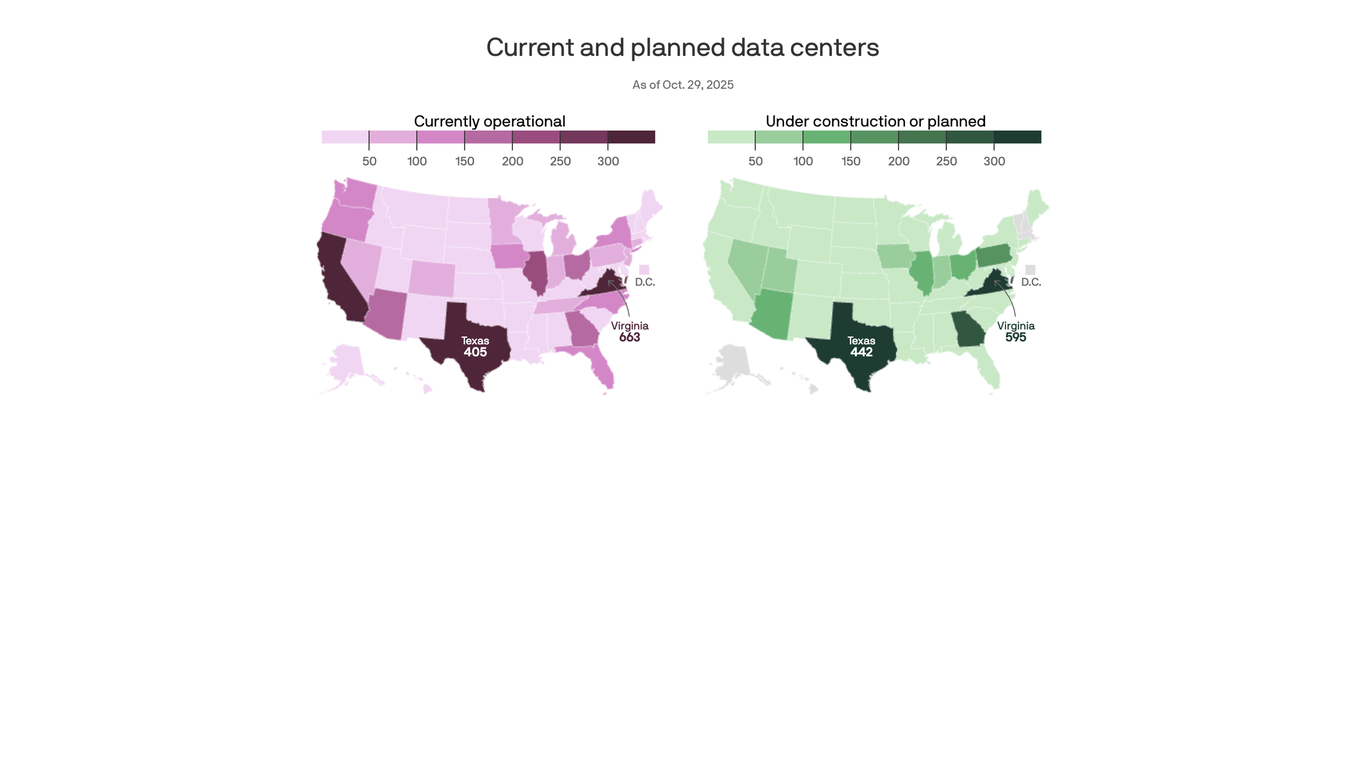

9 months agoMicrosoft Bets Big on North San Jose with New Data Center

Microsoft is continuing its investment in a North San Jose data center despite a pause on other plans, indicating confidence in the project's potential.

The data center is anticipated to produce significant tax revenues and impact fees, benefiting city infrastructure and public services.

[ Load more ]