#us-tariffs

#us-tariffs

[ follow ]

#greenland #nato #greenland-dispute #arctic-security #journalism-funding #iran-protests #china-demand

fromwww.theguardian.com

4 days agoMexico's president says Trump's tariffs on Cuba's oil suppliers could trigger humanitarian crisis

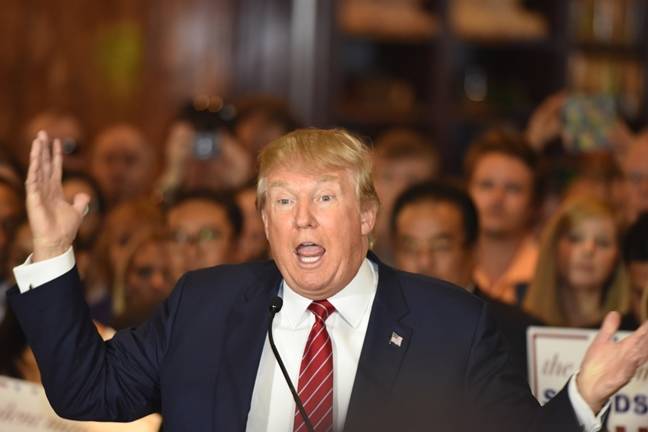

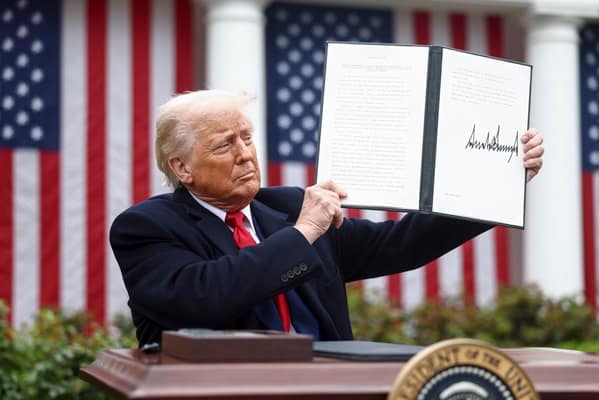

Mexico's president, Claudia Sheinbaum, has warned that Donald Trump's move to slap new tariffs on countries sending oil to Cuba could trigger a humanitarian crisis on the island, which is already suffering from chronic fuel shortages and regular blackouts. The US president signed an executive order on Thursday declaring a national emergency and laying the groundwork for such tariffs, ratcheting up the pressure to topple the communist government in Havana.

World news

fromwww.aljazeera.com

6 days agoWhat will be the impact of the EU-India trade pact?

The mother of all trade deals' comes months after the United States slapped tariffs on India and the European Union. One of the biggest trade deals in history has been struck by India and the European Union, months after United States President Donald Trump hit both with tariffs. What's in the agreement and how much is driven by Washington's unpredictable measures?

Miscellaneous

fromLondon Business News | Londonlovesbusiness.com

1 week agoEuropean markets rally on apparent Greenland deal - London Business News | Londonlovesbusiness.com

By now we have grown accustomed to Trumps strategy of threatening nations with tariffs in a bid to get what he wants, but this occasion appears to have taken it a step too far. For many of the European leaders, this is a warning sign that their US partners are no longer reliable for as long as Trump is in power.

World news

fromwww.independent.co.uk

2 weeks agoUS tariffs have had a huge impact on my small business. Now our future is at risk'

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

US politics

fromAxios

2 weeks agoThe great Davos divorce: America's allies draw red line with Trump

We knew the story of the international rules-based order was partially false. That the strongest would exempt themselves when convenient. That trade rules were enforced asymmetrically. ... That international law applied with varying rigor depending on the identity of the accused or the victim,

World news

World news

fromwww.theguardian.com

2 weeks agoDavos: US treasury secretary Scott Bessent urges Europe not to retaliate over Greenland tariffs business live

Trade tensions over Greenland sparked market turmoil, prompting calls for calm and urging countries to maintain trade deals despite US tariff threats.

Europe politics

fromwww.theguardian.com

2 weeks agoWhat are Trump's latest tariff threats and could the EU hit back with its big bazooka'?

The US threatened tariffs on goods from several European countries over Greenland, and the EU may retaliate using its anti-coercion instrument (ACI) with sweeping trade countermeasures.

fromwww.independent.co.uk

2 weeks agoGold and silver soar to record highs amid Trump tariff threat

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging. At such a critical moment in US history, we need reporters on the ground.

US politics

World news

fromFortune

2 weeks agoMoscow cheers NATO crisis as the Ukraine war stifles Russia's economy, forcing companies to use 4-day weeks and lay off workers | Fortune

Trump's tariffs and Greenland purchase attempt are causing a major NATO rift that could weaken support for Ukraine and benefit Russia.

Miscellaneous

fromFortune

2 weeks agoEurope can wield this $8 trillion 'sell America' weapon as Trump reignites a trade war over his Greenland conquest ambitions | Fortune

The EU can leverage its large holdings of U.S. Treasuries and equities to retaliate financially against U.S. tariffs, exerting significant geoeconomic pressure.

fromwww.theguardian.com

2 weeks agoTrump's tariff threat is an attempt to divide Europe and quash opposition over Greenland

Donald Trump's threat to impose fresh tariffs on eight European countries UK, Norway and six EU member states is a wrecking ball to the carefully stitched deals he concluded with those countries last summer. The two biggest voting blocs in the European parliament, the European People's Party (EPP) and the Socialists & Democrats (S&Ds), said on Saturday night the deal with the EU cannot be approved in the present circumstances.

US politics

fromwww.dw.com

2 weeks agoGerman firms hunker down as Trump marks one year in office

The first year of Donald Trump's second term has been anything but calm amid a flurry of executive orders by the US president targeting alleged "opponents" at home and abroad, and negatively affecting transatlantic trade and business. Trump's so-calledLiberation Day announcement of "reciprocal tariffs" last April shocked governments and companies alike across the world, as did his crackdown on corporate diversity, equality and inclusion (DEI) initiatives.

US politics

frominsideevs.com

2 weeks agoTrump Is Ready For Chinese EVs: 'Let China Come In'

Less than a year ago, automakers found themselves on the cusp of tariff hell. Car companies were suddenly hit with a gut-punch of tariffs on their supply chains and completed vehicles. The U.S. imposed some hefty import duties on all things China in the hopes of protecting domestic manufacturers. Now President Trump is welcoming Chinese cars into the U.S.as long as they build them here.

US politics

fromLondon Business News | Londonlovesbusiness.com

3 weeks agoWhat's hot and what's not in e-commerce and home deliveries for 2026 - London Business News | Londonlovesbusiness.com

2026 is already shaping up to be a challenging year. Soft seasonal peak sales through November and December last year and increased staffing costs don't give a sturdy foundation for retailers and manufacturers to build on. However, there are some significant gains to be made, especially around tech improvements. In fact, Parcelhero will be unveiling its own AI-powered tracking and messaging services this year for individuals and growing businesses.

E-Commerce

US politics

fromLGBTQ Nation

3 weeks agoWhite House slammed for considering sending $100,000 to each Greenlander while taxing Americans more - LGBTQ Nation

U.S. officials discussed paying Greenland residents $10,000–$100,000 to encourage secession while U.S. tariffs have increased costs for American consumers.

fromwww.aljazeera.com

3 weeks agoEU states' nod on Mercosur trade deal ends 25-year wait

The deal, which comes as Brussels seeks new markets to offset US tariffs and reduce reliance on China for critical minerals, will open free trade with four South American countries. European Union ambassadors have given a provisional nod to the bloc's largest-ever agreement in terms of erased tariffs, opening the way to free trade with the Mercosur group of South American countries.

Miscellaneous

fromSecuritymagazine

3 weeks agoNew Update on Jaguar Land Rover Cyberattack: Q3 Wholesales Down 43%

A report on the company's wholesale and retail sales reveals both decreased in the third quarter of fiscal year 2026 (FY26). Wholesales were down 43.3% compared to Q3 FY25 (at approximately 59,200 units), while retail sales were down 25.1% (at approximately 79,600 units). Although the report states this decrease was partially influenced by a "planned wind down of legacy Jaguar models ahead of the launch of new Jaguar," it also notes that production disruption caused by the previous year's cyberattack impacted these numbers.

Cars

fromwww.theguardian.com

3 weeks agoThe pressure is too much': Lesotho's garment workers on the frontline of Trump tariffs

Every morning at 7am, women gather outside clothing factories in Maseru, the capital of the southern African mountain kingdom of Lesotho, hoping to be offered work. However, since Donald Trump imposed swingeing global tariffs in April 2025, those opportunities have been fewer and farther between. Moleboheng Matsepe lost her full-time job sewing sports leggings for the California brand Fabletics in 2023. She was initially able to pick up three-month contracts, but has not had any work since September.

World news

fromFortune

1 month agoCopper records biggest annual gain since 2009 on supply bets | Fortune

Copper had its best year since 2009, fueled by near-term supply tightness and bets that demand for the metal key in electrification will outpace production. The red metal has notched a series of all-time highs in an end-of-year surge, rallying 42% on the London Metal Exchange this year. That makes it the best performer of the six industrial metals on the bourse. Prices dipped 1.1% Wednesday, the last trading day of 2025.

Business

fromFortune

1 month agoTrump's tariffs actually slashed the deficit from a record $136.4 billion to less than half that. Here's what else they did | Fortune

Since returning to the White House in January, President Donald Trump has overturned decades of U.S. trade policy - building a wall of tariffs around what used to be a wide open economy. His double-digit taxes on imports from almost every country have disrupted global commerce and strained the budgets of consumers and businesses worldwide. They have also raised tens of billions of dollars for the U.S. Treasury.

US politics

fromwww.theguardian.com

1 month agoScottish whisky market slides into supply glut amid falling sales and US tariffs

The Scottish whisky market has slipped into a supply glut as US tariffs and falling demand weigh on the country's distilleries. Global scotch sales fell 3% in the first half of 2025, marking the third consecutive year of decline after decades of growth, according to the alcohol data provider IWSR. The slowdown comes as distilleries grapple with uncertainty around Donald Trump's trade tariffs, as well as declining rates of alcohol consumption.

Food & drink

US politics

fromFortune

1 month agoSoutheast Asian economies prove resilient in the face of Trump's tariffs as supply chains expand | Fortune

U.S. tariffs triggered Chinese transshipping through ASEAN, boosting Southeast Asian exports, prompting U.S. and Chinese trade deals and supporting ASEAN growth.

fromFortune

2 months ago'There's only so much you can absorb from the tariffs, because they're just very high': Levi's CEO states the plain truth | Fortune

The global fashion industry is bracing for 2026, navigating a market defined by geopolitical instability, macroeconomic uncertainty, and, above all, unprecedented U.S. tariffs. As leaders pivot from focusing on "uncertainty" to acknowledging the environment is simply "challenging," tariffs have emerged as the number one hurdle facing executives. The severity of the trade landscape cannot be overstated, executives told McKinsey and the Business of Fashion for the 2026 edition of the "State of Fashion" report.

Fashion & style

fromFortune

2 months agoHow Malaysia shrugged off Trump's tariffs, according to its finance minister: 'We didn't panic' | Fortune

Just about every major exporting economy was hit by U.S. President Donald Trump's "Liberation Day" tariffs in April. Malaysia was no exception, getting a 24% "reciprocal tariff" on its exports to the U.S. which, while perhaps not as catastrophic a level as some of its neighbors, still posed a significant threat to the Southeast Asian economy. Yet, Malaysia's government took a more measured response to new U.S. protectionism.

World news

Miscellaneous

fromIrish Independent

2 months agoUncertainty globally and tariffs likely to prompt spending fall in Irish economy

Ireland largely avoided direct harm from recent US tariffs and tax changes, but heightened geopolitical uncertainty will reduce investment and consumer spending, slowing growth and job creation.

[ Load more ]