Retirement

from24/7 Wall St.

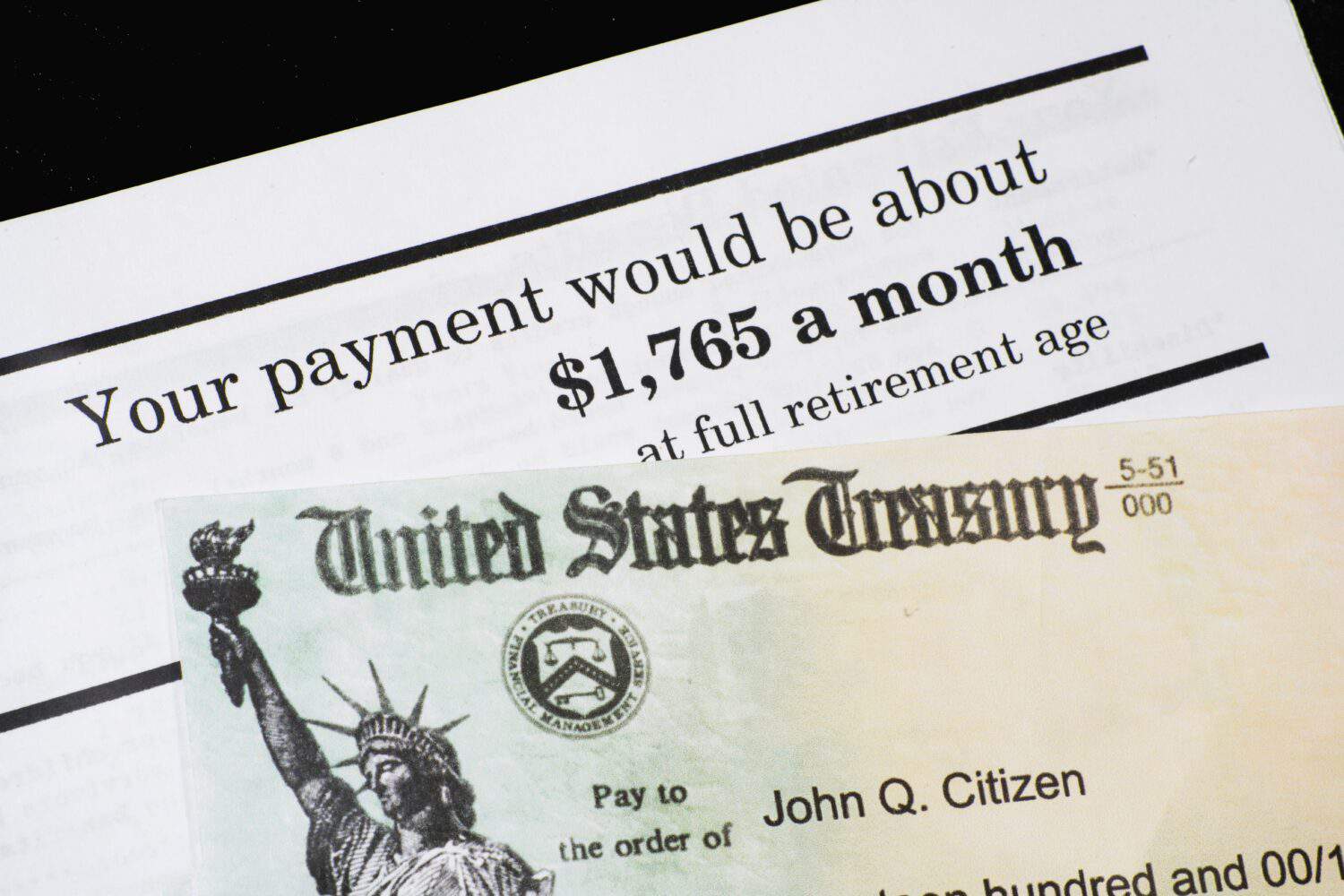

11 hours agoSuze Orman: Stop Doing This One Thing or Your Social Security Check Won't Last

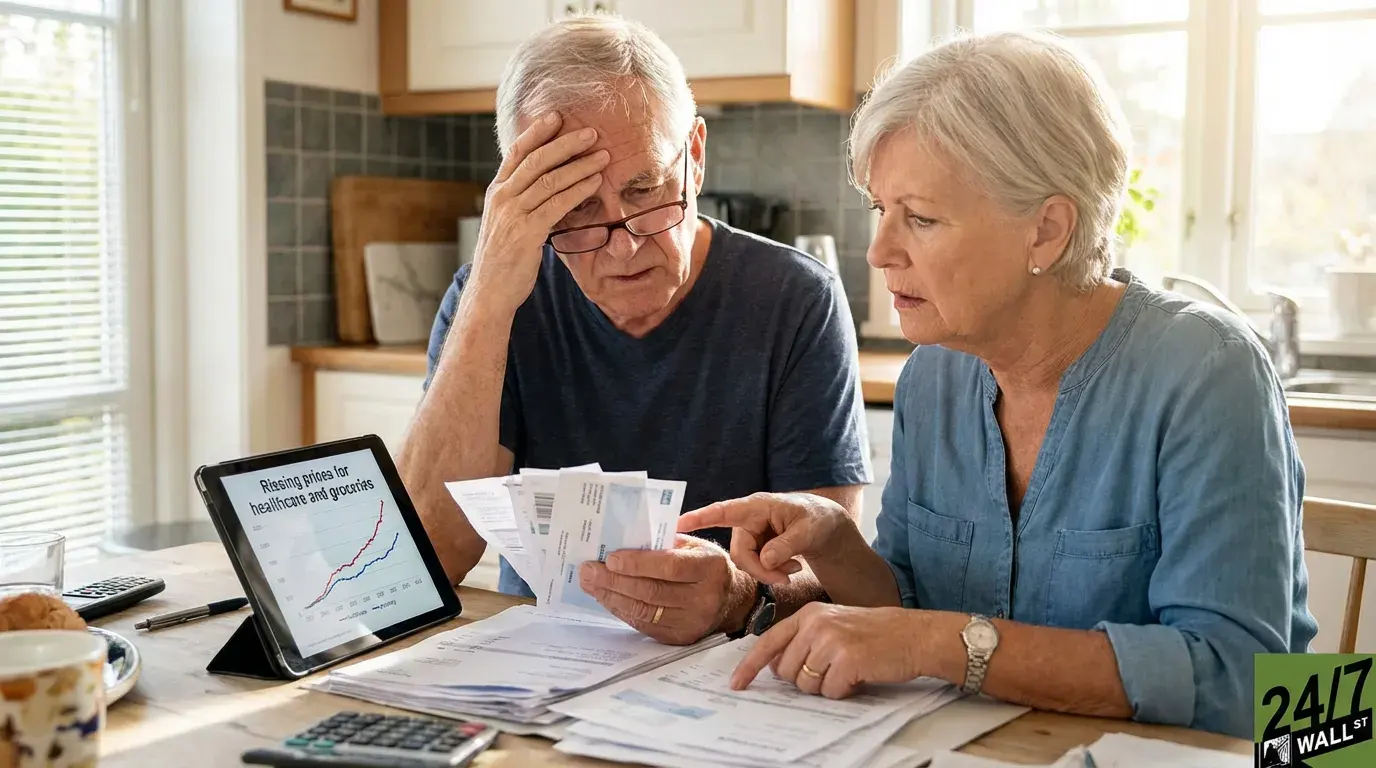

Discretionary daily spending—especially dining out and coffee—can consume over a quarter of average Social Security benefits, jeopardizing retirement financial security.