#retirement-planning

#retirement-planning

[ follow ]

#social-security #4-rule #asset-allocation #claiming-age #withdrawal-rate #inflation #withdrawal-strategy

from24/7 Wall St.

13 hours agoDave Ramsey Tells 57-Year-Old Investing $2,800 Monthly to Cut Retirement Contributions in Half

A 57-year-old woman and her 68-year-old husband were doing everything right by conventional standards - investing 35% of their take-home pay into retirement accounts. But this aggressive retirement strategy created an unexpected problem: they couldn't save enough for a down payment on their first home. On a January 2026 episode of The Dave Ramsey Show, the couple received counterintuitive advice that challenged standard financial wisdom.

Real estate

US news

from24/7 Wall St.

5 days agoRetiree Tax Traps: 15 States Where Per-Person Tax Burdens Are Over the National Average

State and local per-capita tax collections vary widely and can substantially reduce retirees' lifetime savings, making location a critical factor for fixed-income retirement planning.

from24/7 Wall St.

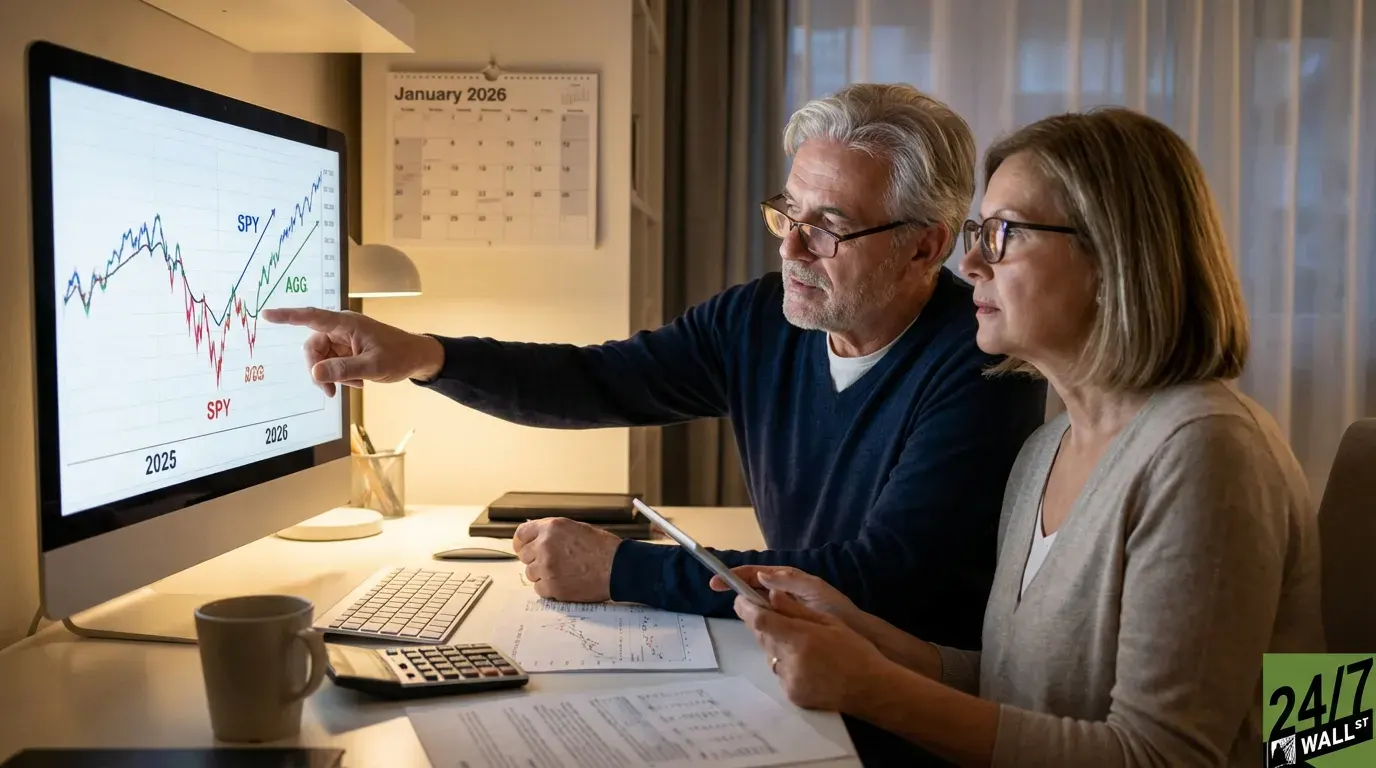

1 week agoYour $1.5 Million Nest Egg Runs Out 5 Years Early When Inflation Hits 4.5%

Using a deterministic projection model with 7% annual portfolio returns (SPY's 10-year annualized return is 13.6%) and inflation-adjusted withdrawals: Under 3% inflation, the $1.5M portfolio sustains withdrawals until approximately age 89 (year 23). Starting with $60,000 in year one, withdrawals grow to $69,700 by year five and $80,900 by year ten. The portfolio balance drops to $1.38M by year five, $1.18M by year ten, and reaches depletion around year 23.

Retirement

Real estate

fromBoston Condos For Sale Ford Realty

1 week agoIs Tapping 401K To Buy A Boston Condo A Good Idea? Boston Condos For Sale Ford Realty

Using 401(k) funds for a home risks long-term retirement by causing permanent loss of compound growth, taxes, penalties, reduced liquidity, and job-related loan exposure.

from24/7 Wall St.

1 week agoSocial Security Faces $460 Monthly Cut Per Retiree Unless Congress Acts

The Old-Age and Survivors Insurance Trust Fund faces a critical milestone in 2033 when its reserves are projected to run dry. This doesn't mean Social Security disappears-payroll taxes from current workers will continue flowing in, but those taxes alone won't cover full benefits. The gap between incoming revenue and promised payments creates the funding crisis. Without congressional action, the program could only pay about 77% of scheduled benefits.

US news

from24/7 Wall St.

1 week agoThe 4% Withdrawal Rule Breaks Down When You Need Your Money to Last 30 Years

The difference between planning for 20 versus 30 years of retirement isn't just an extra decade, it fundamentally reshapes every financial assumption you make. With Americans living longer and retiring earlier, a 30-year retirement horizon has become increasingly common, requiring a complete rethinking of withdrawal rates, asset allocation, and income sustainability. The math behind a 30-year retirement reveals the challenge.

Retirement

from24/7 Wall St.

1 week agoShe Lost Her Spouse and Financial Plan; Now $60,000 Must Last Until Age 90

The fundamental challenge centers on balancing immediate income security against longevity risk. With life expectancy potentially extending 20 to 25 years, inflation will erode purchasing power significantly. A woman retiring today at 66 could live into her late 80s or beyond, meaning her portfolio must sustain withdrawals while maintaining growth. Social Security survivor benefits provide the foundation. A widow receives the higher of her own benefit or 100% of her deceased spouse's benefit. If she received $2,000 monthly but her husband received $3,200, she now gets $3,200. However, household expenses don't drop proportionally. Research shows a surviving spouse typically needs 75% to 80% of the couple's previous income.

Business

from24/7 Wall St.

2 weeks agoSuze Orman says everyone should invest in a 401(k) - but never use it for this

Now, let's say you lose your job before the money plus interest is paid back. You still have to pay back whatever the remaining balance is on that loan. And if you don't have the money to pay it back, it will be taxed to you as ordinary income. That's in addition to the 10% penalty if you were under the typical retirement age of 59 1/2.

Business

from24/7 Wall St.

2 weeks agoA $700,000 Stock Portfolio Lost $146,000 in Five Days, Showing Exactly Why Retirees Need Cash

Paying off your mortgage and entering retirement debt-free is a major accomplishment. It reduces monthly expenses and eliminates interest payments that drain your portfolio. But debt freedom alone doesn't guarantee financial security. Without adequate cash reserves, even a well-funded retirement can unravel when markets drop or unexpected expenses hit.

Retirement

from24/7 Wall St.

2 weeks agoThat $85,000 Retirement Only Looks Comfortable Until You Hit Year 20

An $85,000 annual retirement income is well above median U.S. household income and could cover most middle-class expenses. But whether this provides genuine security or hidden risk depends on where the money comes from and how long it needs to last. On Reddit's r/FinancialPlanning forum, one user asked how much they'd need saved to live on $80,000 annually, with responses emphasizing "you need $2,000,000 today for $80,000 a year to last at least 30 years, including increases for inflation."

Retirement

Retirement

from24/7 Wall St.

3 weeks agoSocial Security Experts Warn The Government 'must break its promise on Social Security' to avoid 'imminent insolvency'

Social Security reserves are projected to be exhausted by late 2032, triggering an automatic 24% reduction in benefits unless Congress enacts a fix.

from24/7 Wall St.

3 weeks agoHow Much Monthly Income Does a $2 Million Portfolio Produce at Age 60?

Arguably, the most important consideration here is that when you turn 60, you have to think through the idea that you want your money to last for at least 25-30 years. In other words, how you structure your portfolio is more than just how to generate income, it's also how to maintain purchasing power as costs rise because of inflation.

Retirement

Real estate

fromwww.morningstar.com

4 weeks ago'I'm ready to walk away': I have $400K in retirement savings and want to quit my job of 30 years. Can I do it?

A 62-year-old with $227,520 in a 401(k), ~$180,000 inherited IRA, $80,000 savings, and $1,900 Social Security contemplates retirement using the IRA to bridge to Medicare.

fromLondon Business News | Londonlovesbusiness.com

4 weeks agoInterest rate cuts is welcome relief for borrowers, but a growing challenge for savers - London Business News | Londonlovesbusiness.com

Hard-earned funds are getting more and more squeezed, and that must be a cause for concern. People who have done the right thing-saved consistently and planned carefully-are finding that their money simply doesn't stretch as far as they expected.

Miscellaneous

fromBusiness Insider

1 month agoHow Google, Microsoft, Walmart, and other corporate giants are preparing for an aging workforce

Corporate America is facing a silver tsunami - and some companies are better prepared than others. Walmart is redesigning jobs to keep older workers on the payroll. Microsoft is offering what it calls "wraparound care" to support healthy aging. Google is coaching its employees to prepare for retirement. Some smaller companies have introduced chief longevity officers to help workers navigate health, wellness, and the transition into retirement.

Business

[ Load more ]