#venture-capital

#venture-capital

[ follow ]

#artificial-intelligence #nyc-startups #ai-startups #cybersecurity #ai #healthtech #startups #fundraising

Venture

fromBusiness Insider

17 hours agoVenture capital is in reset mode. These are the investors rising fastest now.

Early-career venture capitalists are gaining prominence as market shifts favor rigorous diligence and founder relationships, especially in AI-driven startups focused on customers and revenue.

fromBusiness Insider

1 day agoWatch live: BI's Rising Stars of VC list

This year, 37 up-and-coming investors made the list of rising stars of venture capital. In this live Q&A, hear how the list is put together and learn about the hottest trends in venture capital. Plus, catch an interview with one of this year's winners. Scroll down for the live video on Tuesday at 1:30 p.m. ET.

Venture

fromFortune

3 days agoSilicon Valley legend Kleiner Perkins was written off. Then an unlikely VC showed up | Fortune

Independently and immediately, a flood of people reached the same conclusion: This had to be a mistake. It was the summer of 2017, and as word spread that Mamoon Hamid was joining venture capital firm Kleiner Perkins, some people wondered if it was a joke, or "fake news." And they didn't hold back. "I got calls from friends in the venture business, other GPs [general partners], asking: 'Are you sure this is happening? Is this real?'" Hamid recounts.

Venture

fromFortune

5 days agoEscape Velocity raises a $62 million fund to bet on 'DePIN' crypto networks for telescopes, solar energy, and more | Fortune

While Bitcoin treads water to start 2026, sentiment for other niches in crypto has soured even more-especially DePIN, or decentralized physical infrastructure. Tokens for the decentralized cellphone service Helium and the decentralized mapping network Hivemapper, for example, are near all-time lows. Still, some investors remain bullish on the concept, including the upstart venture firm Escape Velocity, which has raised $61.74 million for a second fund to back founders in DePIN and crypto more broadly.

Venture

fromTechCrunch

6 days agoAI security startup Outtake raises $40M from Iconiq, Satya Nadella, Bill Ackman and other big names | TechCrunch

Outtake, founded in 2023 by a former Palantir engineer, Alex Dhillon, has found a way to automate what has largely been the manual problem of spotting and taking down digital identity posers: impersonation accounts, malicious domains posing as the company's, rogue apps, fraudulent ads, and more. This problem has grown even more difficult because AI has enabled attackers to be more convincing and faster in their efforts.

Artificial intelligence

Pets

fromFortune

6 days agoAs vet bills jump 40% in recent years, startup Snout raises $110 million for its 'membership' model to defray costs | Fortune

U.S. households now more often have pets than children, driving demand for pet-focused financial products like Snout’s preventative-care memberships and veterinary financing.

Venture

fromLondon Business News | Londonlovesbusiness.com

6 days agoLitestream Ventures saw $78m in non-binding investor pledges during Davos - London Business News | Londonlovesbusiness.com

Litestream Ventures' Davos forum enabled $78.1M in non-binding investor pledges for 12 companies and a charity using proprietary pledge-signalling technology.

Medicine

fromFortune

1 week agoInside Big Pharma, VC's big bet on AI: 'We wouldn't fly in an airplane designed by hand, but all of our drugs are designed like that' | Fortune

AI-driven drug design aims to narrow the astronomical chemical search space and accelerate medicine development, backed by major funding and breakthroughs like AlphaFold.

Artificial intelligence

fromFortune

1 week agoOpenAI's former head of sales is entering VC. She still calls herself an 'AGI sherpa' | Fortune

Aliisa Rosenthal left OpenAI after scaling its sales organization to join Acrew Capital as general partner to advise startups on pricing, GTM, AI-native sales, and scaling.

fromBusiness Insider

1 week agoHow startups can 'break through the noise' and grab attention, according to a marketer-turned-VC

"You can have as much money as you want to pour into the algorithm and buy ads," Kaplan told Business Insider. "But if you don't have the right founder who's able to build a community and the attention that you need to build a real product that people want, all of that money ... is meaningless."

Startup companies

Fundraising

fromwww.theguardian.com

1 week agoWhy is the UK state investing in 6.45bn Kraken? It doesn't need public money

The British Business Bank invested 25m in Kraken Technologies despite Kraken's multi-billion valuation and strong fundraising, raising doubts about the BBB's focus on small businesses.

fromFuncheap

1 week agoAI for Good Pitch Competition: Win Funding + Mentorship (Palo Alto)

where visionary founders showcase AI-driven innovations designed to create meaningful, positive impact. This event spotlights startups leveraging artificial intelligence, deep tech, and frontier technologies to solve real-world challenges and transform industries for the better. Selected startups will pitch live to a distinguished panel of venture capitalists and technology leaders, sharing their mission, traction, and measurable impact in a fast-paced, interactive format.

Artificial intelligence

Venture

fromTechCrunch

1 week agoOpenAI's former sales leader joins VC firm Acrew: OpenAI taught her where startups can build a 'moat' | TechCrunch

Aliisa Rosenthal joined Acrew Capital as a general partner to invest in and scale enterprise AI startups using specialization and persistent context-driven moats.

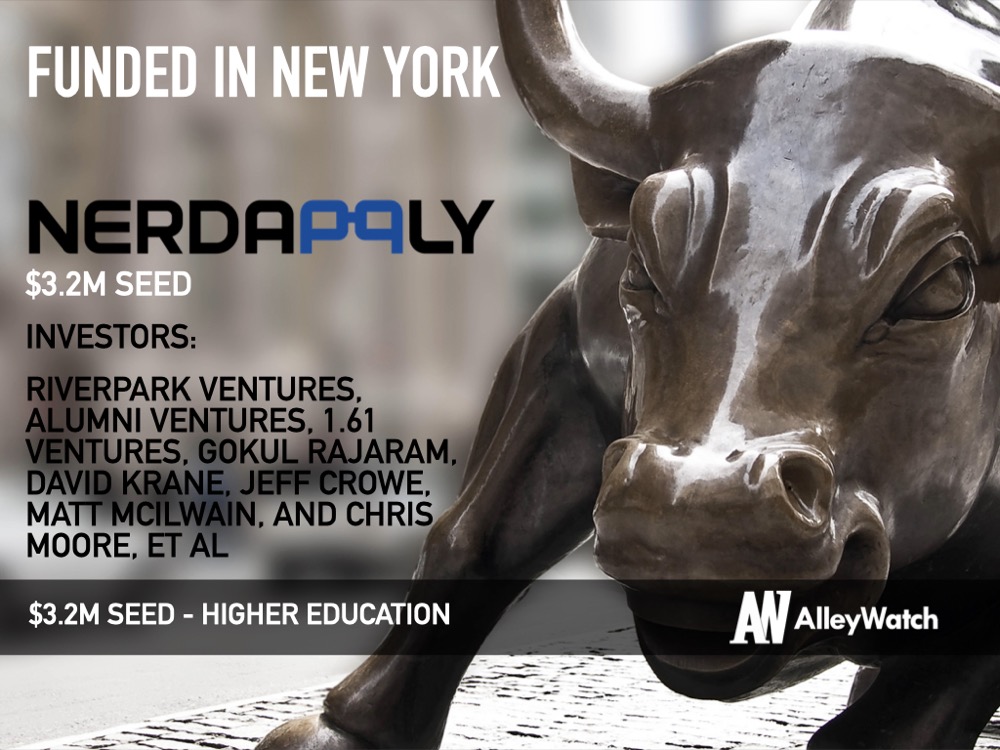

fromAlleywatch

2 weeks agoThe AlleyWatch Startup Daily Funding Report: 1/20/2026

The latest venture capital, seed, pre-seed, and angel deals for NYC startups for 1/20/2026 featuring funding details for Verse Gaming, Cosmos, and much more. This page will be updated throughout the day to reflect any new fundings. Cosmos - $15M Series A CREATIVE TECH Cosmos, a platform for creatives to discover, save, and organize visual inspiration, has raised $15M in Series A funding led by Shine Capital and Matrix. Founded by Andy McCune and Luca Marra in 2021, Cosmos has now raised a total of $21M in reported equity funding.

Venture

fromTechCrunch

2 weeks agoSequoia to invest in Anthropic, breaking VC taboo on backing rivals: FT | TechCrunch

As part of OpenAI's defense against Musk's lawsuit, Altman addressed rumors about restrictions in OpenAI's 2024 funding round. While he denied that OpenAI investors were broadly prohibited from backing rivals, he did acknowledge that investors with ongoing access to OpenAI's confidential information were told that access would be terminated "if they made non-passive investments in OpenAI's competitors."

Venture

fromBusiness Insider

2 weeks agoAn OpenAI researcher turned venture capitalist says investors are 3 to 5 years behind the latest AI studies

Jenny Xiao, who cofounded Leonis Capital in 2021 after a stint at OpenAI, said the current investment excitement around AI is far behind the actual research. "There is a massive disconnect between what researchers are seeing and what investors are seeing," Xiao said on the Fortune Magazine podcast this week. What's being discussed at the biggest AI conferences is as much as 3 to 5 years behind what researchers are thinking about, Xiao said.

Artificial intelligence

fromSFGATE

2 weeks agoHow a dispute with a Russian billionaire led to 4 Bay Area biotech bankruptcies

A fierce dispute between an American venture capital firm and the family investment office of a Russian billionaire has trickled down into the Bay Area. In December and January, four local biotech companies with stakes in the battle each filed for bankruptcy. The argument pits New York's Apple Tree Partners, a biotech-focused venture investor, against Rigmora, an investment entity owned by the family office of Dmitry Rybolovlev, who made his billions in the Russian fertilizer industry.

Venture

fromBusiness Insider

2 weeks agoShe and 4 friends quit their jobs to make a mobile game. Now, they've raised $30 million in a Series A led by A16z.

It was the most chaotic two weeks of my life," Sumer told Business Insider, adding that at one point, she told her then-fiancé that wedding planning would be left to him, and she'd just show up to get married.

Venture

fromBusiness Insider

2 weeks agoBen Horowitz says that investing teams shouldn't be 'too much bigger than basketball teams'

Ben Horowitz is a big fan of tiny teams. On an episode of the A16z podcast, the Andreessen Horowitz cofounder shared how his venture capital firm maintains a lean operation despite being one of the world's largest. "An investing team shouldn't be too much bigger than a basketball team," he said, referring to advice he got from famed American investor David Swensen in 2009. He added, "A basketball team is five people who start, and the reason for that is the conversation around the investments really needs to be a conversation."

Venture

fromwww.housingwire.com

3 weeks agoLuxury Presence raises $37M to push CRM platform development

Presence CRM integrates contact data, communication history, website activity and third-party information to monitor changes such as property ownership records, employment updates and other indicators that may signal a future real estate transaction. The system is designed to generate suggested outreach and prioritize contacts based on those signals, the company said. Luxury Presence said Presence CRM will be included across its platform offerings and is scheduled to begin rolling out in early 2026.

Real estate

fromTechCrunch

3 weeks agoSuperorganism raises $25M to back biodiversity startups | TechCrunch

You could think of us a lot like a climate tech fund, but instead of thinking about, where can we emit less carbon dioxide or avoid emissions in the first place, we're doing the same thing for nature loss,

Venture

fromBusiness Insider

3 weeks agoMarc Andreessen says being controversial gives his VC firm an 'incredible competitive advantage'

Most executives wobble at the thought of controversy. Marc Andreessen embraces it. The venture capitalist and cofounder of Andreessen Horowitz has been a lightning rod for Silicon Valley, voicing his opinions loudly and publicly. That includes drawing a fair share of backlash - something he seems unfazed by. "Generally speaking, the more out there we are, and the more outspoken we are, and the more controversial we are, the better for the business," Andreessen said on " The A16z Show."

Venture

fromTechCrunch

3 weeks agoThe venture firm that ate Silicon Valley just raised another $15 billion | TechCrunch

The haul represents over 18% of all venture capital dollars allocated in the United States in 2025, according to firm co-founder Ben Horowitz, but even more jaw-dropping is that it brings the organization to more than $90 billion in assets under management, putting it neck-and-neck with Sequoia Capital as among the largest venture firms in the world. Which is fitting, since a16z appears to be very friendly with actual sovereign wealth funds, including at least one from Saudi Arabia.

Venture

fromBusiness Insider

4 weeks agoVC firms don't often make their top lawyer a partner. Menlo Ventures just did.

Menlo has elevated Carrillo, its general counsel and only in-house lawyer, to partner after nearly six years with the firm - a rare distinction inside a venture fund. Carrillo's promotion suggests the role of the legal department is shifting in the venture industry. Carrillo said she's at the table for weekly partner meetings where they pitch deals and bat around ideas.

Venture

Venture

fromBusiness Insider

1 month agoDavid Sacks' prediction sparks debate: 'Miami will replace NYC as the finance capital and Austin will replace SF as the tech capital'

Miami could become the U.S. financial capital and Austin the U.S. tech capital as investors and companies relocate amid tax and ideological shifts.

fromTechCrunch

1 month agoAlmost 80 European deep tech university spinouts reached $1B valuations or $100M in revenue in 2025 | TechCrunch

Universities and research labs have long been Europe's deep tech treasure trove. Now, academic spinouts have consolidated into a solid startup funnel worth $398 billion - and VC money is following. According to Dealroom's European Spinout Report 2025, 76 of these deep tech and life sciences companies have either reached $1 billion valuations, $100 million in revenue, or both. These include unicorns like Iceye, IQM, Isar Aerospace, Synthesia, and Tekever, which are now inspiring more funds to back university spinouts.

Venture

fromBusiness Insider

1 month agoI'm a 15-year-old who got advice from Mark Cuban and Paul Graham over email. Here's how I craft my cold reach-outs.

When I was younger, at 8, I loved building things. I started coding very early. Then I turned 12, I did this entrepreneurship program, and I got really into it. I kept trying to build these companies, these little side projects, but nothing took off. Eventually, I realized a really important thing you need to have is knowledge. I knew nothing about tech or venture capital. I decided to learn everything the best way I could, which is by talking to the most knowledgeable people.

Venture

fromBusiness Insider

1 month agoThese 11 retail startups raised millions from VCs this year, from Gopuff to Stickerbox

With venture capital pouring into artificial intelligence, retail startups are struggling to compete for funding. PitchBook has tracked $396 million worth of VC deals in retail through December 19 of this year, down from a recent peak of $7.6 billion in 2021. In the age of AI, new companies are under more pressure to prove their value to VCs. Founders are saying that the enormous fundraising seen during the pandemic has subsided in 2025.

Venture

fromwww.mediaite.com

1 month agoIlhan Omar's Husband Purges Names from VC Firm's Website

Rep. Ilhan Omar (D-MN) is once again under fire this time because her husband Tim Mynett's $25 million venture capital firm, Rose Lake Capital, purged key officer details amid growing questions about the couple's wealth and Minnesota's ongoing welfare fraud investigations. According to her latest financial disclosure in May, the couple's net worth surged 3500% in just one year; their net worth is now anywhere from $6 million to $30 million. The venture capital firm alone, per the filing, is worth between $5 million-$25 million.

US politics

fromTechCrunch

1 month agoWhat's ahead for startups and VCs in 2026? Investors weigh in | TechCrunch

Founders must prove to VCs they have more than just traction; they need a distribution advantage. Investors are digging deeper into repeatable sales engines, proprietary workflow/processes and deep subject matter expertise that holds up against the 'capital arms race'. VCs no longer care about who's first to market with a flashy demo. They want to know who's building something that can last, earn trust, and scale long-term.

Venture

Venture

fromFortune

1 month agoCEO of a $134 billion software giant blasts companies with billions in funding but zero revenue: 'That's clearly a bubble, right... it's, like, insane' | Fortune

AI startup valuations are inflated despite little or no revenue, creating a significant bubble that could worsen before market correction.

fromBusiness Insider

1 month agoBusiness Insider wants your nominations for its Rising Stars of Longevity 2026

Longevity - or living healthier for longer - is a hot topic, drawing millions of readers to Business Insider and driving billions of dollars of investment worldwide. It's easy to see why the promise of a medical fountain of youth is enticing to both the average person and those peddling snake oil, looking to make a quick buck. That's why Business Insider is launching its Rising Stars of Longevity list, to celebrate and acknowledge those in the longevity space outpacing their peers with meaningful, impactful work.

Science

fromBusiness Insider

1 month agoHealthcare VCs predict more AI transparency investment, private equity M&A, and a quiet year for IPOs in 2026

2025 saw a welcome surge in healthcare venture funding as investors rushed to back top AI startups. Last December, VCs predicted huge funding rounds for AI scribe startups like Abridge and Ambience Healthcare; indeed, both Abridge and Ambience landed hundreds of millions of dollars in venture funding this year. Investors also said in December 2024 that they anticipated a race for those startups to expand beyond AI health scribing into other product lines, like medical coding and billing.

Healthcare

[ Load more ]