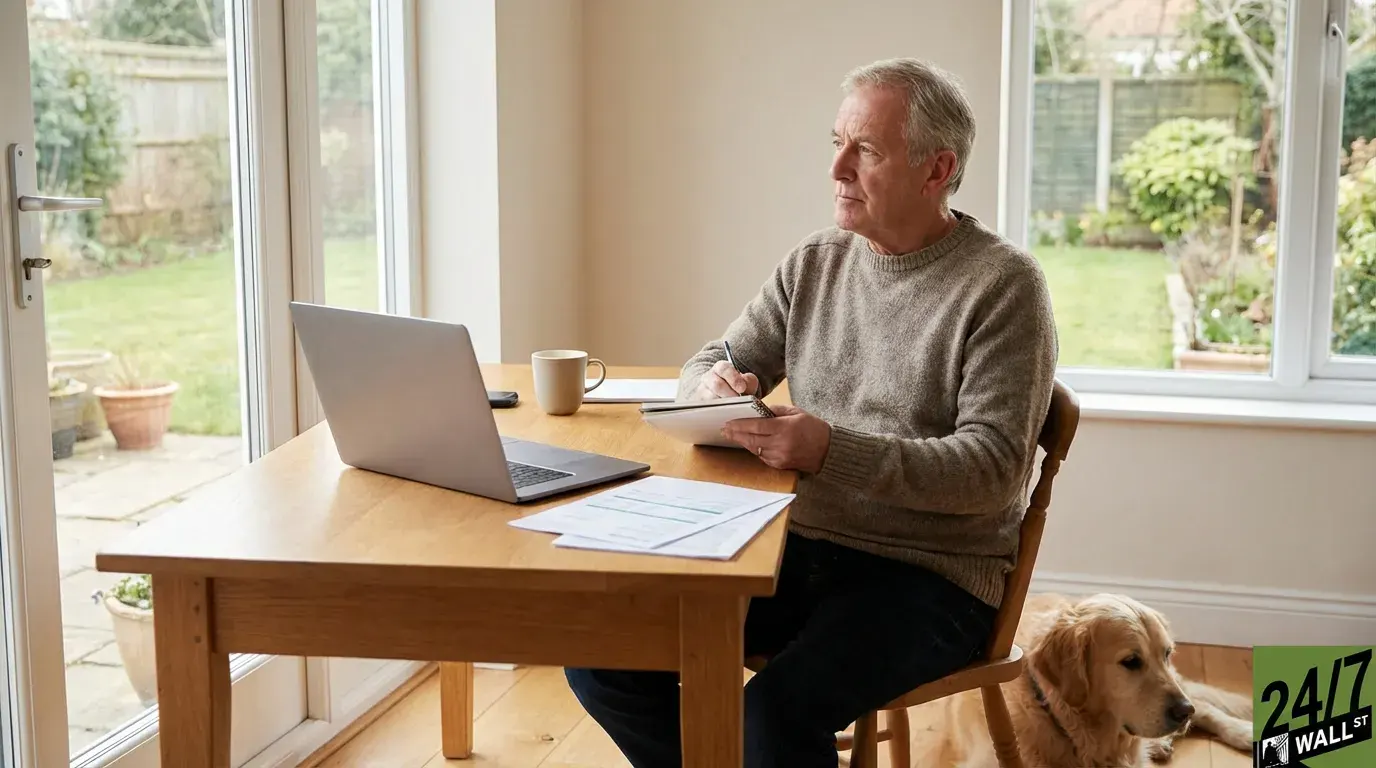

Retirement

fromSubstack

9 hours agoStop Thinking About Taxes As an April Problem

Treat taxes as year-round automated maintenance: organize documents, do projections, save for payments, make estimated payments, hire a CPA, and file extensions strategically.